Economics_A-level_Edexcel

-

1-1-nature-of-economics6 主题

-

1-2-how-markets-work10 主题

-

1-3-market-failure4 主题

-

1-4-government-intervention2 主题

-

2-1-measures-of-economic-performance4 主题

-

2-2-aggregate-demand-ad5 主题

-

2-3-aggregate-supply-as3 主题

-

2-4-national-income4 主题

-

2-5-economic-growth4 主题

-

2-6-macroeconomic-objectives-policies4 主题

-

3-1-business-growth3 主题

-

3-2-business-objectives1 主题

-

3-3-revenues-costs-and-profits4 主题

-

3-4-market-structures7 主题

-

3-5-labour-market3 主题

-

3-6-government-intervention2 主题

-

4-1-international-economics9 主题

-

4-2-poverty-inequality2 主题

-

4-3-emerging-developing-economies3 主题

-

4-4-the-financial-sector3 主题

-

4-5-role-of-the-state-in-the-macroeconomy4 主题

-

5-1-the-exam-papers3 主题

-

5-2-economics-a-level-skills1 主题

-

5-3-structuring-your-responses9 主题

role-of-central-banks

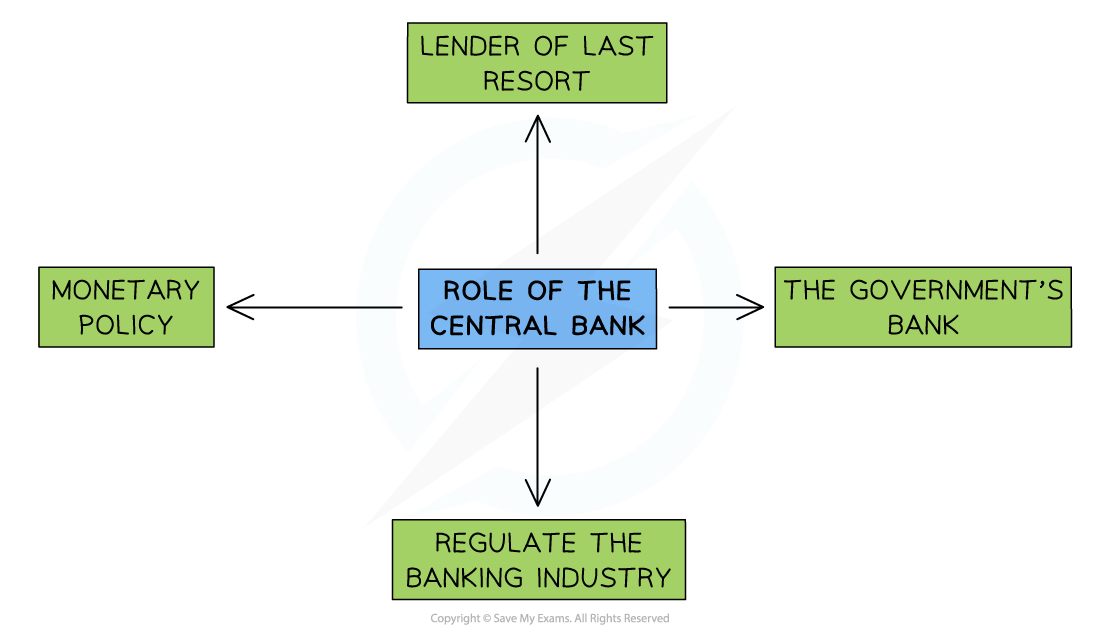

Key Functions of Central Banks

-

Central Banks play a vital role in maintaining stability in the financial system. Additionally, the policy tools at their disposal help to meet Government economic objectives and create economic growth

-

Implementation of monetary policy: This was covered more fully in Sub-topic 2.6.2

-

Banker to the government: The Government sets the annual budget but it is the Central Bank that manages the tax receipts and payments. In 2022 there were 5.7 million public sector workers in the UK who had to be paid each month

-

Banker to the banks – lender of last resort: Commercial banks are able to borrow from the Central Bank if they run into short-term liquidity issues. Without this help, they might go bankrupt leading to instability in the financial system – and a potential loss of savings for many households

-

Regulation of the banking industry: the high level of asymmetric information in financial markets requires that commercial banks are regulated in order to protect consumers. One of the key regulatory actions to manage the money supply and promote stability in the financial system is the implementation of required reserve ratios. Raising the ratio decreases the money supply in the economy – and vice versa

Responses