Business_A-level_Edexcel

-

1-marketing-and-people

1-1-meeting-customer-needs3 主题 -

1-2-market5 主题

-

1-3-marketing-mix-and-strategy5 主题

-

1-4-managing-people5 主题

-

1-5-entrepreneurs-and-leaders6 主题

-

2-managing-business-activities2-1-raising-finance4 主题

-

2-2-financial-planning4 主题

-

2-3-managing-finance3 主题

-

2-4-resource-management4 主题

-

2-5-external-influences3 主题

-

3-business-decisions-and-strategy3-1-business-objectives-and-strategy4 主题

-

3-2-business-growth4 主题

-

3-3-decision-making-techniques4 主题

-

3-4-influences-on-business-decisions4 主题

-

3-5-assessing-competitiveness3 主题

-

3-6-managing-change3 主题

-

4-global-business4-1-globalisation5 主题

-

4-2-global-markets-and-business-expansion5 主题

-

4-3-global-marketing3 主题

-

4-4-global-industries-and-multinational-corporations3 主题

-

5-exam-technique5-1-the-exam-papers4 主题

-

5-2-business-studies-skills1 主题

-

5-3-structuring-your-responses5 主题

-

6-pre-release-preparation2025-pre-release-music-industry9 主题

3-5-1-interpretation-of-financial-statements

Using the statement of comprehensive income

-

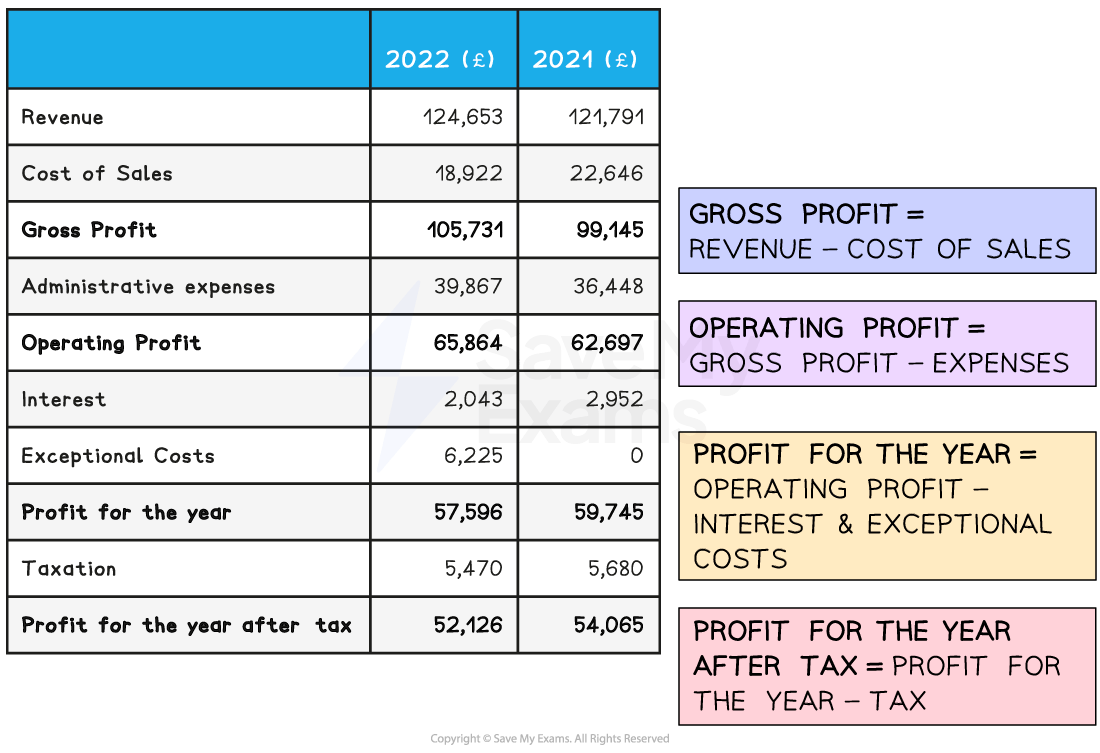

The statement of comprehensive income is also known as the profit and loss account

-

It shows the income and expenditure of a business over a period of time — usually a year — and calculates the amount of profit made (see sub-topic 2.3.1)

Example of a statement of comprehensive income for Head to Toe Wellbeing Ltd

-

The extract from the statement of comprehensive income for Head to Toe Wellbeing Ltd shows figures for both 2022 and the previous year, allowing comparison over time

Stakeholder interest in the statement of comprehensive income

-

The profit and loss account is a very useful source of information for stakeholders to evaluate the performance of a business

-

Shareholders

-

Interested in profits earned, business growth and dividend payments

-

-

Employees

-

Interested in profits earned and potential for wage increases and job stability

-

-

Managers and directors

-

Interested in key performance data, such as an improvement in sales revenue and net profit

-

-

Suppliers

-

Interested in the continued success of the company that they are supplying

-

This information is also used by suppliers to determine the level of trade credit offered to businesses

-

-

Government

-

Used to determine how much tax is payable

-

-

Local community

-

Interested in the stability of the business and what this may mean for jobs in the community

-

Another interest is to see if the firm is generating enough profit to perhaps approach them for local sponsorship

-

-

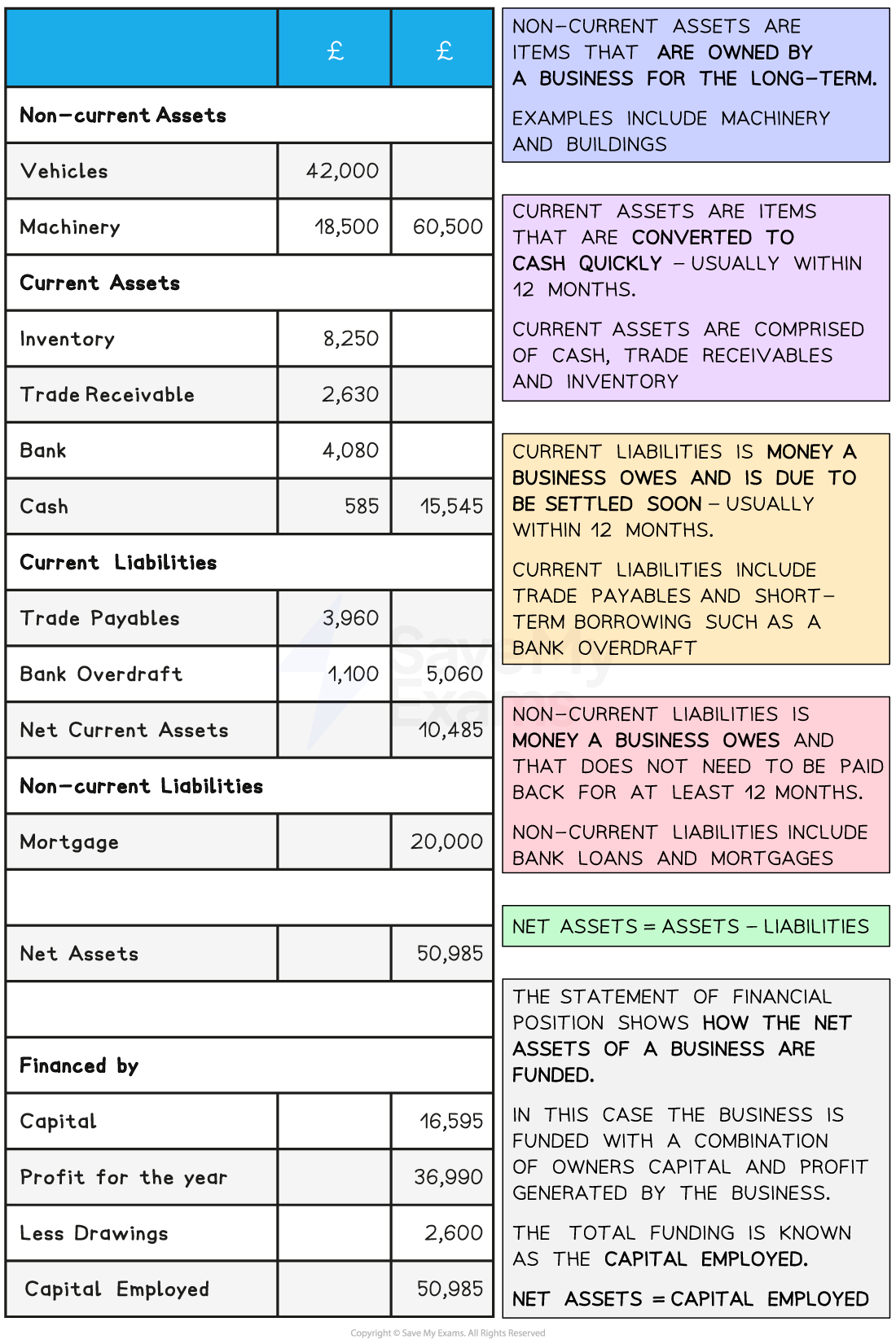

Using the statement of financial position (balance sheet)

-

The statement of financial position, sometimes called the balance sheet, contains the financial information required to draw conclusions about the liquidity of the business

-

Liquidity is the ability of a business to meet its short-term commitments (e.g. payments to creditors) with its available assets

-

A business that cannot pay its bills will usually fail very quickly, even if it is profitable

-

Managing liquidity is a key way to manage risk in a business and helps a business prepare for the unexpected

-

-

The statement of financial position shows the financial structure of a business at a specific point in time

-

It identifies a business’s assets and liabilities and specifies the capital (money) used to fund the business

-

The statement of financial position is also known as the balance sheet

-

Example of a statement of financial position for Packer Sports Ltd

Stakeholder interest in the statement of financial position

-

Stakeholders will use the statement of financial position alongside the statement of comprehensive income to perform ratio analysis and compare performance over time or with other businesses

How stakeholders use the statement of financial position

|

Stakeholder |

Interest in the statement of financial position |

|---|---|

|

Shareholders |

|

|

Managers and directors |

|

|

Suppliers and creditors |

|

|

Employees |

|

Examiner Tips and Tricks

Information found in the profit and loss account and the balance sheet can be used in a range of answers.

For example, if you are answering a question about sources of finance, you might be able to use the capital structure of the business to recommend whether a business should borrow or look at an alternative source.

If a business already relies heavily on borrowing, it may be more sensible to recommend seeking to raise more share capital.

Responses