The effects on businesses of changing economic variables

-

Economic influences can present significant opportunities and threats to business activities

-

Businesses need to anticipate and respond to changing economic variables in order to maximise their chance of success

-

The following economic variables need to be considered

Inflation

-

Inflation is the general rise in prices in an economy over time

-

The Consumer Price Index (CPI) measures monthly changes in the prices of a range of goods and services and compares these changes to earlier periods, calculating the rate of inflation

-

In the UK government, monetary policy focuses on achieving a 2% inflation rate and tasks the Bank of England with taking steps to maintain this (e.g. raising the interest rate)

-

-

After several decades of relatively low levels of inflation, the UK has recently experienced rapidly increasing levels

Rapid inflation is causing problems for businesses and households in the UK

-

High or fluctuating levels of inflation can be problematic for businesses for several reasons

Problems caused by inflation

-

Increased costs

-

Workers often demand higher wages to compensate for the increase in the cost of living

-

Suppliers increase the costs of raw materials and components

-

Utilities, such as electricity, become more expensive

-

-

Higher repayments on loans

-

Interest rates usually rise as the Bank of England uses the base rate as a tool to control inflation, making new and variable-rate borrowing more expensive

-

-

Consumers change spending habits

-

Inflation deters consumers from making significant purchases, and they may reduce demand for their usual lower-priced wants too, e.g cinema tickets

-

Purchasing on credit becomes more expensive

-

-

International competitiveness

-

Where domestic inflation rates are higher than those in other countries:

-

UK businesses are less likely to be competitive and lose sales

-

Imports from overseas competitors are likely to be cheaper than domestic goods

-

-

-

Uncertainty

-

This occurs when businesses cannot predict prices even in the short term

-

Survival may need to become the key business objective until stability returns

-

Spending and contract decisions are likely to be delayed

-

Exchange rates

-

The exchange rate is the value of one currency expressed in terms of another

-

Exchange rates are an important economic influence for businesses that import raw materials and components and for businesses that export their products

-

Exchange rates fluctuate for a range of reasons, including:

-

Changing demand for a currency

-

Economic growth

-

Changes to interest rates

-

The impact on business of changes in currency values

|

Change to currency value |

Impact on exporting businesses |

Impact on importing businesses |

|---|---|---|

|

An increase in the value of the £ against other currencies (appreciation) |

|

|

|

A decrease in the value of the £ against other currencies (depreciation) |

|

|

Examiner Tips and Tricks

Many businesses are affected as both importers of raw materials and components and as exporters of goods and services overseas.

It would be unusual for UK-based exporters to wholeheartedly celebrate a weak pound or be entirely dismayed at a strong pound, as the global nature of business means that for many firms, both costs and revenues are affected by exchange rate movements.

For most businesses, exchange rate stability is more important in the medium to long term because volatility makes planning, forecasting and setting objectives very difficult.

Interest rates

-

The interest rate is a percentage reward offered for saving money, and the percentage charged for borrowing money

-

Lenders commonly charge interest on borrowing at a rate higher than the Bank of England base rate

-

They then offer a lower rate on savings and investments

-

-

If interest rates rise, businesses will have to pay more on new or variable-rate borrowing, which will increase their costs

-

Businesses may be less willing to make capital investments when their retained profit may be more profitably invested in savings schemes

-

Customers are less likely to purchase goods on credit when interest rates are high, leading to a fall in sales

-

Exporting businesses may see the demand for their products overseas fall, as higher interest rates usually strengthen the value of the domestic currency and make their products comparably more expensive abroad

Taxation and government spending

-

Governments impose direct and indirect taxes on businesses and households

-

Direct taxes are levied on income, e.g. income tax and corporation tax

-

Indirect taxes are levied on spending, e.g. value-added tax (VAT)

-

The impact of an increase in taxation

|

Impact |

Explanation |

|---|---|

|

Revenue |

|

|

Costs |

|

|

Business decisions |

|

-

Increased government spending is usually funded by increases in taxes or increases in public sector borrowing

-

Increased investment spending (e.g. on roads or regeneration) can encourage businesses to invest and lead to economic growth

-

Increased public sector spending can lead to targeted improvements (e.g in public health or education levels) that can improve productivity

-

-

In recent years, the UK government has focused increasingly on the reduction of government spending

-

Infrastructure projects have been scaled back or cancelled

-

E.g. the scale of the planned HS2 (High Speed 2) rail line intended to connect London with cities in the North has been significantly reduced

-

Businesses in cities such as Leeds and Manchester are now unlikely to benefit from more efficient transport links, which affects access to markets and workers

-

-

-

Spending on key services such as health and education has been reduced

-

Public sector wage rises have been limited

-

Businesses have been affected by ongoing strike action across the public sector, which has increased employee absence levels and made it difficult to function effectively

-

-

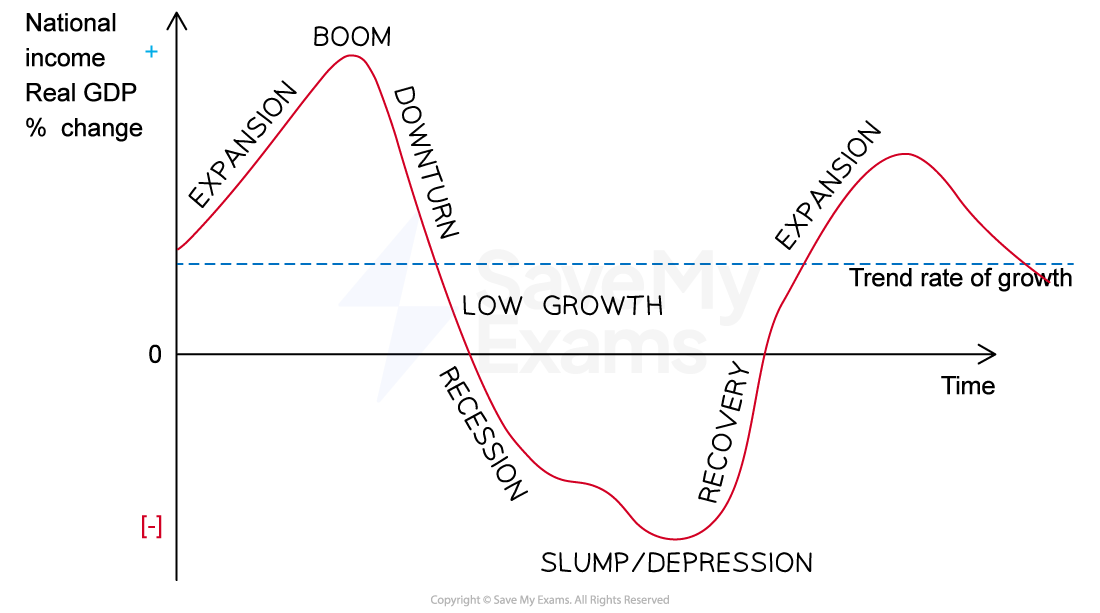

The business cycle

-

The business cycle describes the upturns and downturns in the level of a country’s economic activity (gross domestic product or GDP) over time

-

A recession occurs when an economy experiences two consecutive quarters (six months) or more of negative economic growth

-

A boom is defined as a period of time in which an economy experiences increasing/high rates of economic growth

-

The business cycle over time

|

Stage of the business cycle |

Characteristics |

Impact on businesses |

|---|---|---|

|

Recession |

|

|

Responses