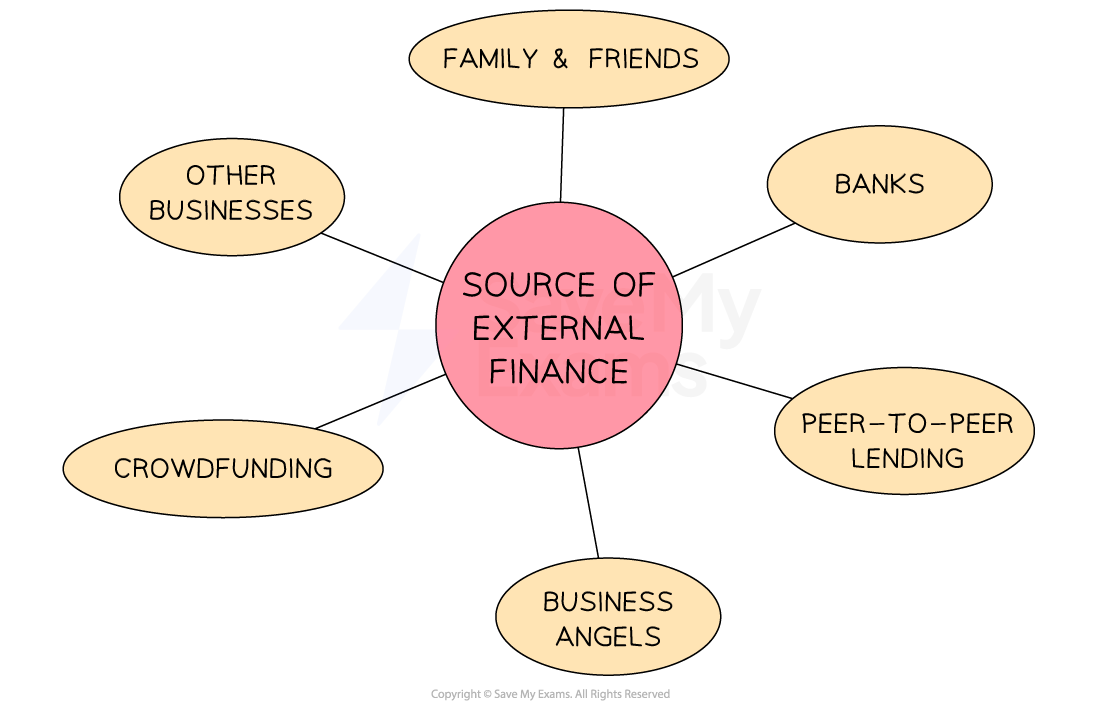

Sources of external finance

-

External finance is sourced from outside of the business

Key sources of external finance

Family and friends

-

Small business owners approach close acquaintances to invest in or lend money to a business

Advantages and disadvantages of family and friends as a source of finance

|

Advantages |

Disadvantages |

|---|---|

|

|

Banks

-

Banks provide several different kinds of loans to businesses

-

Small business loans are monies borrowed by a small business from a bank or lender that must be repaid with interest over time

-

Mortgages are long-term loans used to buy property, where the property acts as security until fully repaid

-

An overdraft is a short-term way to borrow money from a bank by spending more than is in a current account, up to an agreed limit

-

Advantages and disadvantages of lending from banks

|

Advantages |

Disadvantages |

|---|---|

|

|

Peer-to-peer funding

-

Individuals with available savings can pool their savings with others’ in a peer investment scheme, such as Funding Circle

Advantages and disadvantages of peer-to-peer funding

|

Advantages |

Disadvantages |

|---|---|

|

|

Business angels

-

Some individuals specialise in making investments in start-ups or expanding businesses, e.g. Dragons’ Den investors

Advantages and disadvantages of business angels

|

Advantages |

Disadvantages |

|---|---|

|

|

Crowdfunding

-

Crowdfunding is a way of raising finance by asking a large number of people to each contribute a small amount of money

-

The business owner creates a campaign on a crowdfunding website (such as Crowdfunder or Kickstarter), explaining their idea and how much money they need

-

Members of the public can then choose to invest or donate

Different types of crowdfunding

-

Donation-based

-

People give money to support a cause or project without expecting anything in return

-

-

Reward-based

-

Backers receive something in return, such as an early version of the product

-

-

Equity-based

-

People invest in exchange for shares in the business

-

Advantages and disadvantages of crowdfunding

|

Advantages |

Disadvantages |

|---|---|

|

|

-

Investors are often attracted by incentives

-

Examples of incentives include samples or early access to a product

-

E.g. in November 2022, well-known Twitter commentator Russ Jones published his long-awaited book funded via Unbound, a crowdfunding publisher

-

-

Other businesses

-

It may be possible for a business to access finance via a joint venture with another business, such as a key customer or supplier

-

Some large businesses buy shares in other companies as an investment or with the intention of a takeover

-

E.g. in 2018, Mike Ashley, owner of Sports Direct, acquired a stake of just under 30% of Debenhams, a troubled British high street retailer, to eventually take over the company

-

Advantages and disadvantages of finance from other businesses

|

Advantages |

Disadvantages |

|---|---|

|

|

Examiner Tips and Tricks

Recently, some sources of finance have been trickier to access. When assessing external sources of finance in your answers, acknowledge that businesses may find accessing these sources more challenging and expensive than in previous years. Many small to medium-sized businesses are often undercapitalised in their early stages. This has restricted their ability to grow.

Peer-to-peer lending, crowdfunding and sources such as business angels have been able to fill some of the gaps left by changes in the banking industry.

Recognising that a business may not be able to achieve its objectives due to an inability to borrow can be a useful evaluative point.

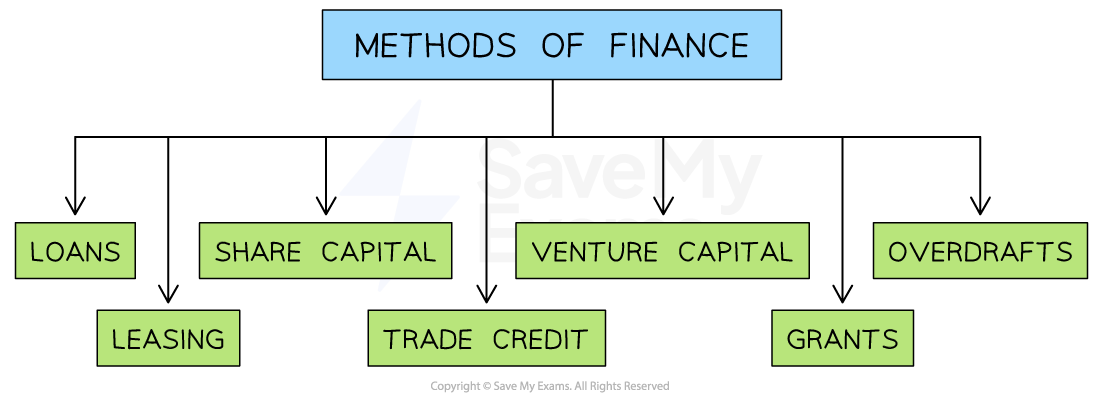

Methods of finance

-

Businesses have many different methods of finance available to help them achieve their objectives

Key methods of external finance

Loans

-

A sum of money is borrowed and repaid (with interest) over a determined period of time

-

Bank loans are usually unsecured and are typically repaid over two to ten years

-

Mortgages are long-term secured loans

-

They are typically used by a business to purchase buildings, land or large items of capital equipment

-

-

Debentures are long-term agreements between a business and a lender to repay a specified amount (with a fixed rate of interest) by a certain date

-

Debenture holders are creditors rather than owners of a business and do not hold voting rights

-

Benefits and drawbacks of loans

|

Benefits |

Drawbacks |

|---|---|

|

|

Responses