Business_A-level_Cie

-

business-and-its-environment

enterprise6 主题 -

business-structure6 主题

-

size-of-business3 主题

-

business-objectives3 主题

-

stakeholders-in-a-business2 主题

-

external-influences-on-business12 主题

-

political-influences

-

legal-influences

-

economic-influences

-

economic-government-macroeconomic-objectives

-

economic-government-policies

-

social-influences

-

the-impact-of-corporate-social-responsibility

-

demographic-influences

-

technology-competitors-and-suppliers

-

international-trade

-

the-impact-of-multinationals

-

environmental-influences

-

political-influences

-

business-strategy10 主题

-

human-resource-managementhuman-resource-management-hrm8 主题

-

motivation4 主题

-

management2 主题

-

organisational-structure5 主题

-

business-communication5 主题

-

leadership2 主题

-

human-resource-strategy3 主题

-

marketingthe-nature-of-marketing7 主题

-

market-research3 主题

-

the-marketing-mix6 主题

-

marketing-analysis5 主题

-

marketing-strategy3 主题

-

operations-managementthe-nature-of-operations3 主题

-

inventory-management2 主题

-

capacity-utilisation-and-outsourcing1 主题

-

location-and-scale2 主题

-

quality-management1 主题

-

operations-strategy4 主题

-

finance-and-accountingbusiness-finance2 主题

-

sources-of-finance3 主题

-

forecasting-and-managing-cash-flows1 主题

-

costs4 主题

-

budgets1 主题

-

financial-statements4 主题

-

analysing-published-accounts6 主题

-

investment-appraisal2 主题

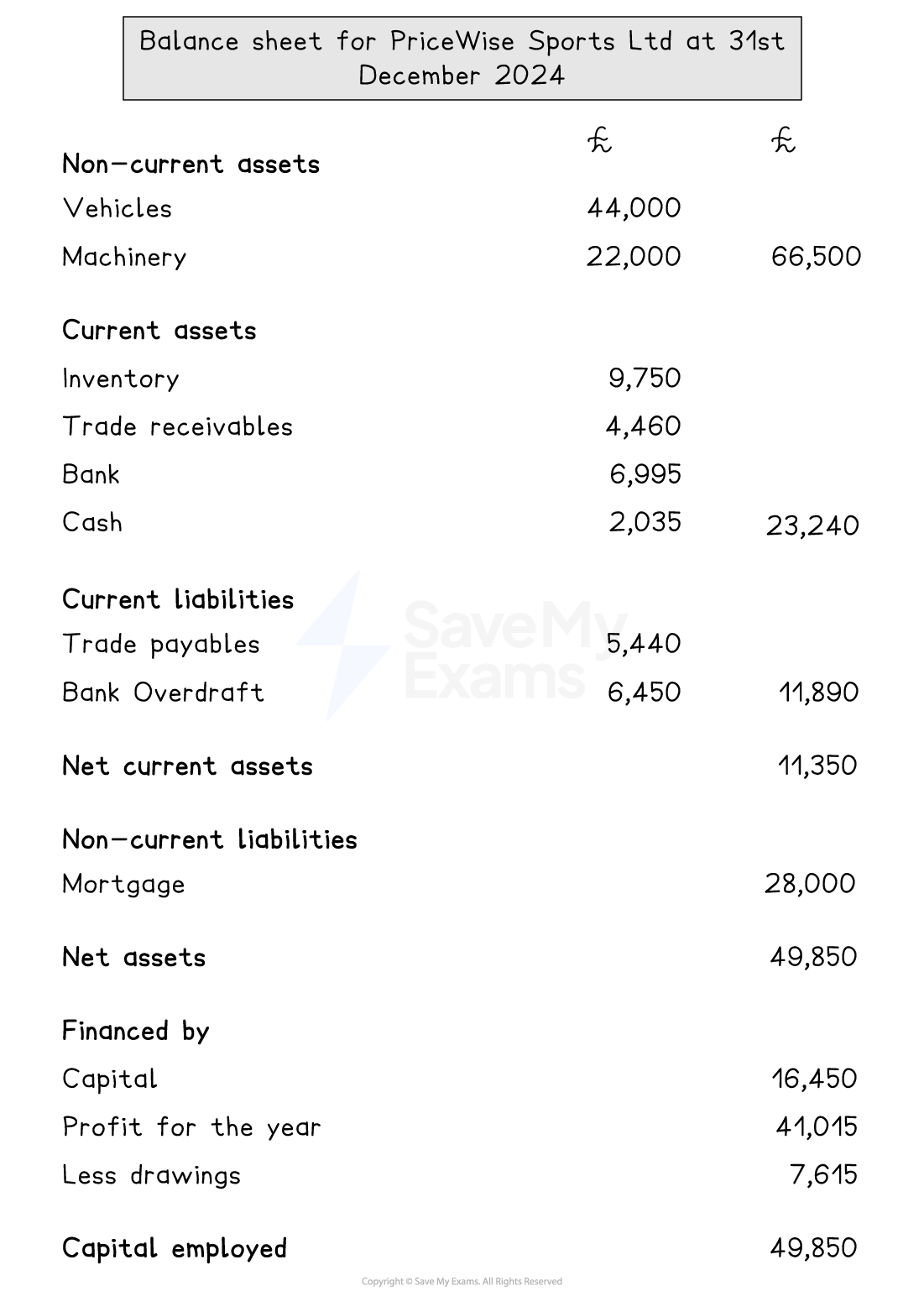

statement-of-financial-position

The purpose of the statement of financial position

-

The statement of financial position provides a snapshot of a business’s financial position at a given point in time

-

It is often called the balance sheet

-

-

It shows what the business owns (assets), what it owes (liabilities), and how it is funded (capital and reserves)

-

It contains the financial information required to draw conclusions about the liquidity of the business

The structure of the statement of financial position

-

The statement of financial position details the following elements at a specific point in time

|

Assets |

|---|

|

|

Liabilities |

|---|

|

|

Capital structure |

|---|

|

A statement of financial position showing key elements

-

In this example, drawings refers to the money (capital) removed from the business by its owner(s)

Amending the statement of financial position

-

A change to one section of the statement of financial position has an impact on other sections

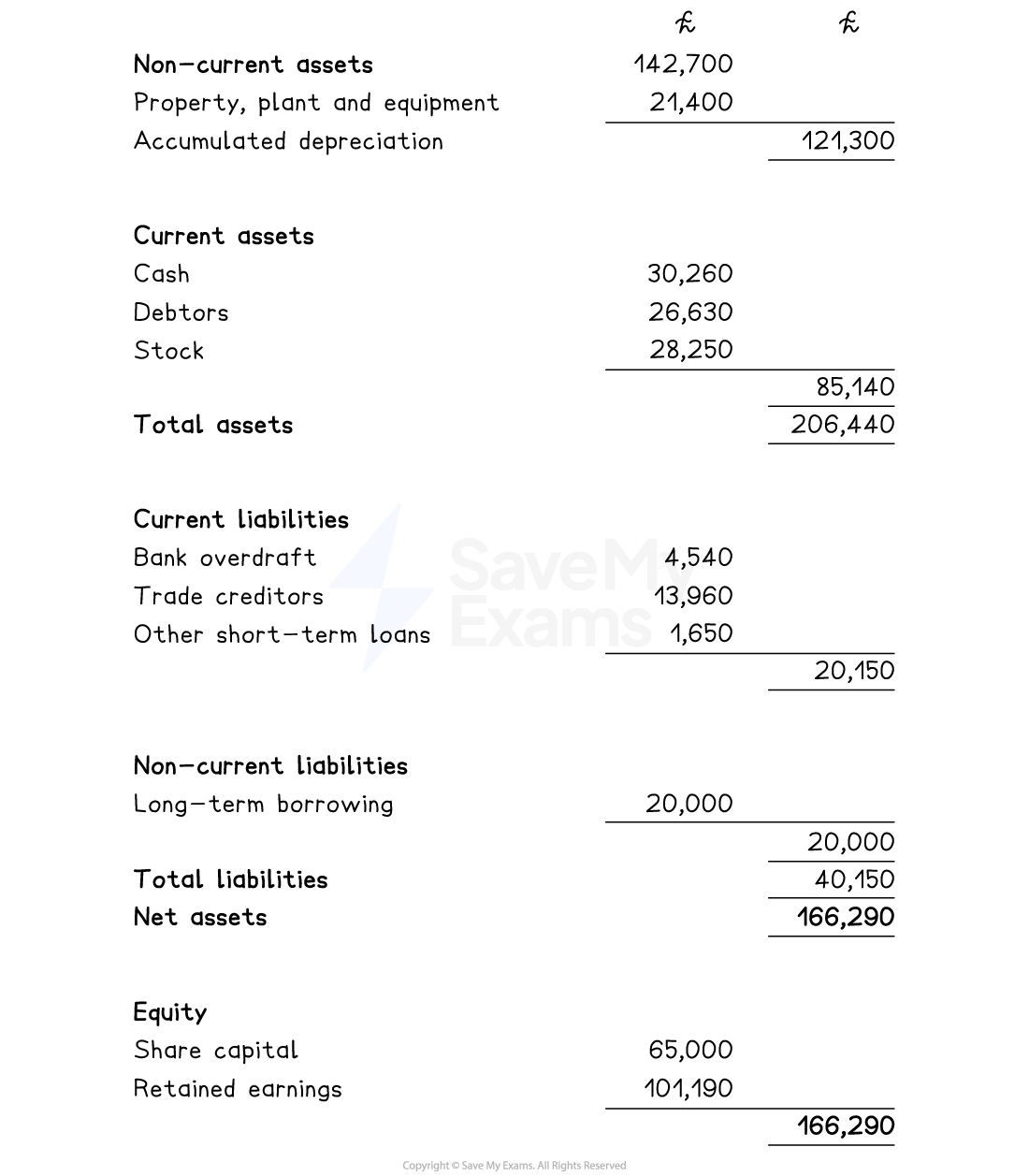

Worked Example

Pershore Plumbers Ltd’s accountant has sent the interim statement of financial position to Helen, the business owner. She has been asked to check the statement before it is sent to Companies House

Pershore Plumbers Ltd – Statement of financial position at 31st March 2025

Helen identifies three errors

-

Depreciation was £24,100

-

An inventory check on 31st March 2025 valued stock at £26,400

-

Long-term borrowing increased to £25,000 as the business took out a further small loan

Recalculate the statement of financial position to reflect these changes.

(6)

Step 1: Update non-current liabilities given the change to depreciation

<img alt=”Non minus current space assets space equals space Asset space value space minus space Depreciation equals space £ 142 comma 700 space minus space £ 24 comma 100 equals space £ 118 comma 600″ data-mathml=”<math ><semantics><mrow><mi>Non</mi><mo>-</mo><mi>current</mi><mo> </mo><mi>assets</mi><mo> </mo><mo>=</mo><mo> </mo><mi>Asset</mi><mo> </mo><mi>value</mi><mo> </mo><mo>-</mo><mo> </mo><mi>Depreciation</mi><mspace linebreak=”newline”/><mspace linebreak=”newline”/><mo>=</mo><mo> </mo><mo>£</mo><mn>142</mn><mo>,</mo><mn>700</mn><mo> </mo><mo>-</mo><mo> </mo><mo>£</mo><mn>24</mn><mo>,</mo><mn>100</mn><mspace linebreak=”newline”/><mspace linebreak=”newline”/><mo>=</mo><mo> </mo><mo>£</mo><mn>118</mn><mo>,</mo><mn>600</mn></mrow><annotation encoding=”application/vnd.wiris.mtweb-params+json”>{“fontFamily”:”Times New Roman”,”fontSize”:”18″,”autoformat”:true,”toolbar”:”<toolbar ref=’general’><tab ref=’general’><removeItem ref=’setColor’/><removeItem ref=’bold’/><removeItem ref=’italic’/><removeItem ref=’autoItalic’/><removeItem ref=’setUnicode’/><removeItem ref=’mtext’ /><removeItem ref=’rtl’/><removeItem ref=’forceLigature’/><removeItem ref=’setFontFamily’ /><removeItem ref=’setFontSize’/></tab></toolbar>”}</annotation></semantics></math>” height=”116″ role=”math” src=”data:image/svg+xml;charset=utf8,%3Csvg%20xmlns%3D%22http%3A%2F%2Fwww.w3.org%2F2000%2Fsvg%22%20xmlns%3Awrs%3D%22http%3A%2F%2Fwww.wiris.com%2Fxml%2Fmathml-extension%22%20height%3D%22116%22%20width%3D%22372%22%20wrs%3Abaseline%3D%2257%22%3E%3C!–MathML%3A%20%3Cmath%20xmlns%3D%22http%3A%2F%2Fwww.w3.org%2F1998%2FMath%2FMathML%22%3E%3Cmi%3ENon%3C%2Fmi%3E%3Cmo%3E-%3C%2Fmo%3E%3Cmi%3Ecurrent%3C%2Fmi%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmi%3Eassets%3C%2Fmi%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmo%3E%3D%3C%2Fmo%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmi%3EAsset%3C%2Fmi%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmi%3Evalue%3C%2Fmi%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmo%3E-%3C%2Fmo%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmi%3ED