An introduction to political influences

-

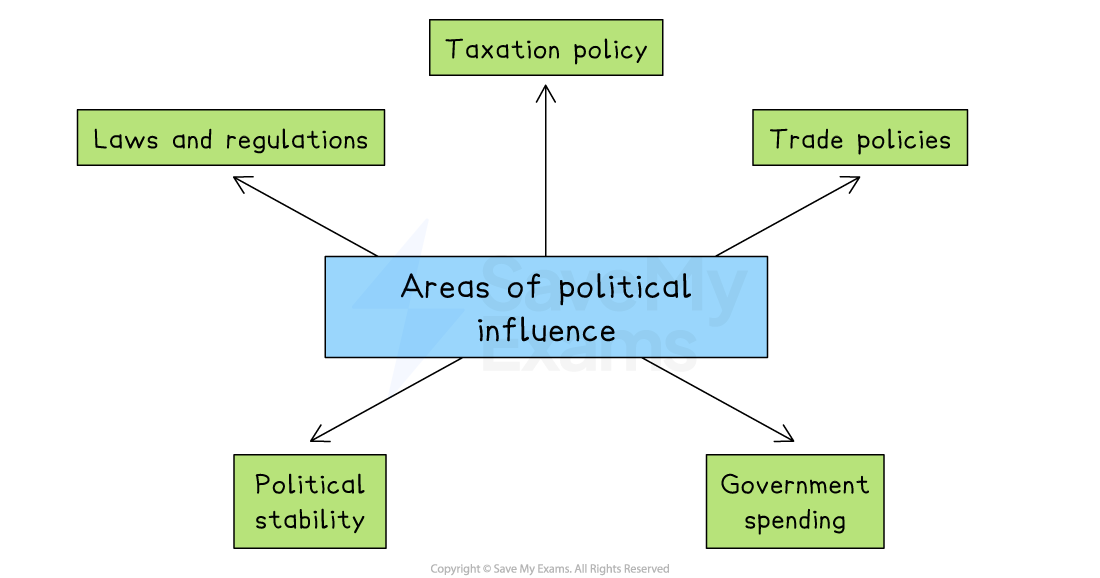

Political influences refer to the ways in which government actions, decisions, and policies can affect how a business operates

-

These can come from local, national or international governments

-

-

Laws and regulations

-

Businesses must follow rules related to health and safety, employment, consumer protection, and the environment

-

Breaking laws can lead to fines, damage to reputation or even being shut down

-

-

Taxation policy

-

Governments decide how much tax businesses must pay

-

Higher taxes can reduce profits

-

Lower taxes may encourage investment or expansion

-

-

Trade policies

-

Includes tariffs, quotas, and free trade agreements

-

These influence how easily businesses can buy and sell goods internationally

-

-

Government spending

-

When governments invest in infrastructure, such as roads, hospitals and schools, certain businesses benefit

-

During economic downturns, governments may also support industries through subsidies or grants

-

-

Political stability

-

Businesses prefer to operate in stable countries where laws and policies are predictable

-

In countries with unrest or frequent policy changes, there is more risk

-

Case Study

Nestlé India and changing environmental regulations

-

In 2019, the Indian government introduced strict environmental regulations to reduce plastic waste

-

This included phasing out single-use plastics, such as plastic straws and wrappers, used in food and beverage packaging

Responses

-

Nestlé India responded to the changing political environment by

-

Re-designing packaging for products, including Maggi noodles and chocolate bars

-

Investing in research to develop recyclable and biodegradable materials

-

Working with suppliers to source new eco-friendly packaging materials

-

Launching campaigns to inform customers of its new sustainability efforts

-

Impacts

-

Costs increased in the short term due to changes in materials and production

-

However, Nestlé improved its brand image, especially among environmentally aware consumers

-

The company avoided legal penalties and reputational damage by acting early

Privatisation

-

Privatisation occurs when government-owned firms are sold to the private sector

-

Examples of industries that are often privatised include transport, energy, telecommunications and healthcare services

-

-

Many government-owned firms have been partially privatised

-

The government retains a share in them so they can influence decision-making and receive a share of the profits

-

e.g. Shares in Singapore Airlines are 55% government-owned and 45% privately owned

-

Advantages of privatisation

1. Raises government revenue

-

Governments earn money from selling state-owned businesses

-

Funds can be used to reduce debt or invest in public services

2. Improves efficiency

-

Private firms aim to cut waste, boost productivity and earn profits

-

Often more innovative and customer-focused than public organisations

3. Reduces government spending

-

Running businesses is costly for governments

-

Selling them reduces long-term financial pressure

4. Encourages investment

-

Private ownership attracts both domestic and foreign investors

-

Can lead to more jobs and economic growth

-

E.g., Nigeria’s sale of NITEL helped expand mobile coverage

-

5. Increases competition and choice

-

Opens markets to new firms, giving consumers more options

-

Can lead to better services and lower prices

-

E.g. Privatising parts of Australia’s rail and electricity sectors led to lower prices for customers

-

Disadvantages of privatisation

|

Disadvantage |

Explanation |

Example |

|---|---|---|

|

Focus on profit over service |

|

|

|

Loss of public control |

|

|

|

Job losses |

|

|

|

Unequal access |

|

|

|

Risk of private monopoly |

|

|

|

Short-term thinking |

|

|

Nationalisation

-

Nationalisation is when a government takes ownership and control of a business or industry from the private sector

-

This means the service or company is now owned by the state and run on behalf of the public

-

-

Nationalisation usually happens in sectors that are considered essential or where private ownership has failed to meet the needs of society

Advantages of nationalisation

-

Nationalisation allows the government to directly manage industries that are vital to the economy or national security, such as transport, healthcare, or energy

-

This means it can set policies in the public interest, such as keeping prices affordable, ensuring services reach rural areas or responding quickly in times of crisis

-

-

Unlike private firms, state-owned businesses don’t need to maximise profit for shareholders

-

This means services can be designed to benefit citizens, workers and consumers more fairly

-

Prices may be lower, access more equal and working conditions more secure

-

-

When a business is nationalised, it may gain financial stability and access to long-term government investment

-

This can be especially helpful if the business was struggling under private ownership

-

Government backing also allows the company to focus on long-term goals, such as infrastructure development or environmental sustainability, without worrying about short-term profit pressures or investor demands

-

Disadvantages of nationalisation

-

Running a nationalised business can be very expensive

-

The government must fund day-to-day operations, invest in maintenance and improvements, and cover losses if the business isn’t profitable

-

This can place a strain on public finances, especially during economic downturns

-

-

Without the pressure to make a profit or compete with rivals, nationalised businesses may become less efficient

-

They might have more bureaucracy, slower customer service, or fewer incentives to innovate

-

Customers and workers may experience delays, outdated technology, or inconsistent quality

-

-

Nationalised businesses can be affected by political pressure, where decisions are made for short-term popularity rather than long-term success

-

Politicians may interfere in areas like pricing, recruitment or expansion, even if it goes against what’s best for the business

-

This can make planning and management difficult, especially as different governments often have diverse priorities

-

Case Study

Nationalisation of YPF – Argentina’s Oil Giant

Scenario

In 2012, the Argentine government made headlines when it nationalised 51% of YPF, the country’s largest oil company, which was majority-owned at the time by the Spanish firm Repsol. This dramatic shift brought a key energy asset back under state control

Reasons for nationalisation

-

Strategic industry control: Oil and gas are essential to Argentina’s economy and energy independence. The government argued that letting a foreign company control such a vital sector was risky

-

Falling investment: Repsol was accused of failing to reinvest enough in Argentina’s oil infrastructure. As a result, domestic production was declining, forcing the country to import more energy, worsening its trade balance

-

Public interest and economic stability: The government believed nationalisation would allow Argentina to boost production, lower fuel import bills, and make energy more affordable and accessible, especially in rural and underserved regions

Outcome

-

Short-term benefits: Nationalisation helped stabilise energy supplies. The state could now steer investment toward long-term infrastructure goals and reduce reliance on imports

-

Increased government control: The move gave Argentina more control over pricing and supply, enabling subsidised fuel prices for domestic consumers

-

Legal and financial fallout: However, the nationalisation sparked international lawsuits. Argentina had to eventually compensate Repsol nearly $5 billion, which strained public finances

-

Efficiency concerns: Critics noted that YPF’s productivity improved slowly, and the firm faced issues with bureaucracy, political interference, and a lack of innovation—typical drawbacks associated with state-run enterprises