Business GCSE AQA

-

The Purpose And Nature Of Businesses Aqa6 主题

-

Business Ownership Aqa4 主题

-

Setting Business Aims And Objectives Aqa3 主题

-

Stakeholders Aqa1 主题

-

Business Location Aqa1 主题

-

Business Planning Aqa1 主题

-

Expanding A Business Aqa2 主题

-

Technology Aqa1 主题

-

Ethical And Environmental Considerations Aqa3 主题

-

The Economic Climate Aqa1 主题

-

Globalisation Aqa2 主题

-

Legislation Aqa1 主题

-

Competitive Environment Aqa2 主题

-

Production Processes Aqa2 主题

-

The Role Of Procurement Aqa3 主题

-

The Concept Of Quality Aqa3 主题

-

Good Customer Service Aqa2 主题

-

Organisational Structures Aqa2 主题

-

Recruitment And Selection Of Employees Aqa4 主题

-

Motivating Employees Aqa1 主题

-

Training Aqa2 主题

-

Identifying And Understanding Customers Aqa1 主题

-

Segmentation Aqa1 主题

-

The Purpose And Methods Of Market Research Aqa3 主题

-

The Elements Of The Marketing Mix Aqa9 主题

-

Sources Of Finance Aqa2 主题

-

Cash Flow Aqa3 主题

-

Financial Terms And Calculations Aqa4 主题

-

Analysing The Financial Performance Of A Business Aqa5 主题

Using Cash Flow Forecasts aqa

Exam code:8132

Completing and interpreting cash flow forecasts

-

A business must first gather information about all cash inflows and cash outflows it expects to encounter over the period

-

The following steps should then be taken to construct the cash flow forecast

Step 1: Calculate total cash inflows

-

In this instance, the business expects to receive cash inflows from sales in March, April and May

-

Owners’ capital of €6,000 will be introduced in March

-

The total for each month is calculated by adding cash from sales to capital introduced

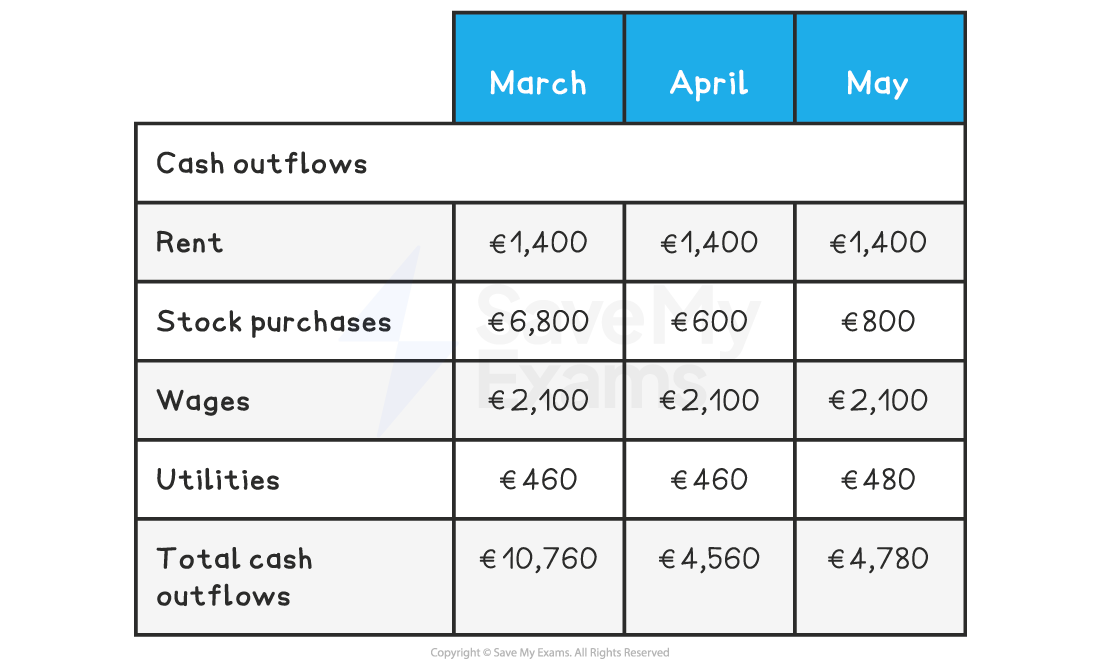

Step 2: Calculate total cash outflows

-

In this instance, the business expects to pay rent of €1,400 in March, April and May

-

It will purchase a significant amount of stock in March, with smaller amounts in April and May

-

Wages are expected to be €2,100 in each month

-

Utilities of €460 will be paid in March and April, increasing to €480 in May

-

Total cash outflows each month is calculated by adding these together

Step 3: Calculate net cash flows

-

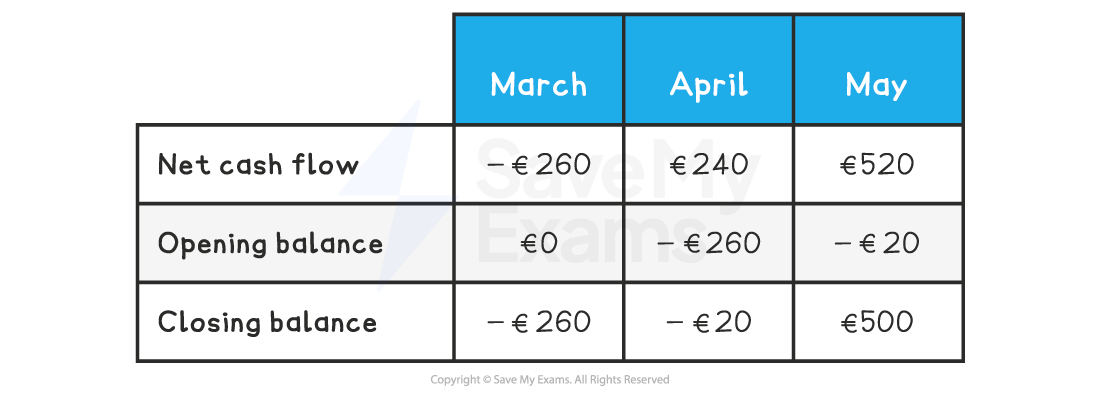

The net cash flow is calculated by subtracting total cash outflows from total cash inflows

-

In March the net cash flow is €10,500 – €10,760 = €(260)

-

Net cash flow is negative as cash outflows are greater than cash inflows

-

-

In April the net cash flow is €4,800 – €4,560 = €240

-

In May the net cash flow is €5,300 – €4,780 = €520

-

In both months, net cash flow is positive as cash inflows are greater than cash outflows

-

Step 4: Calculate opening and closing balances

-

The opening balance is the previous month’s closing balance carried forward

-

The closing balance is calculated by adding the net cash flow to the opening balance

-

In March the opening balance of €0 is added to the net cash flow of €(260) to leave a closing balance of €(260)

-

In April the closing balance from March is carried forward to become its opening balance of €(260)

-

This opening balance is added to April’s net cash flow of €240 to leave a closing balance of €(20)

-

In May the closing balance from April is carried forward to become its opening balance of €(20)

-

This opening balance is added to May’s net cash flow of €520 to leave a closing balance of €500

A complete cash flow forecast

Cash flow forecast analysis

-

Overall, this cash flow forecast shows low cash inflows and significant outflows initially, which lead to negative net cash flow in March and April

-

Healthy sales mean that from April, inflows are greater than outflows and the business has a positive net cash flow

Solutions to cash flow problems

-

The cash flow forecast example above identifies a cash flow problem in March and April where the closing balance is negative

-

It has a range of ways to solve this issue to prevent insolvency

-

The most suitable method may be to arrange a flexible, short-term overdraft facility with its bank

-

Ways to solve cash flow problems

|

Method |

Explanation |

|---|---|

|

Reduce the credit period offered to customers |

|

|

Ask suppliers for an extended repayment period, e.g an extension from 60 to 90 days |

|

|

Make use of overdraft facilities or short-term loans |

|

|

Sell off excess stock |

|

Responses