Business GCSE AQA

-

The Purpose And Nature Of Businesses Aqa6 主题

-

Business Ownership Aqa4 主题

-

Setting Business Aims And Objectives Aqa3 主题

-

Stakeholders Aqa1 主题

-

Business Location Aqa1 主题

-

Business Planning Aqa1 主题

-

Expanding A Business Aqa2 主题

-

Technology Aqa1 主题

-

Ethical And Environmental Considerations Aqa3 主题

-

The Economic Climate Aqa1 主题

-

Globalisation Aqa2 主题

-

Legislation Aqa1 主题

-

Competitive Environment Aqa2 主题

-

Production Processes Aqa2 主题

-

The Role Of Procurement Aqa3 主题

-

The Concept Of Quality Aqa3 主题

-

Good Customer Service Aqa2 主题

-

Organisational Structures Aqa2 主题

-

Recruitment And Selection Of Employees Aqa4 主题

-

Motivating Employees Aqa1 主题

-

Training Aqa2 主题

-

Identifying And Understanding Customers Aqa1 主题

-

Segmentation Aqa1 主题

-

The Purpose And Methods Of Market Research Aqa3 主题

-

The Elements Of The Marketing Mix Aqa9 主题

-

Sources Of Finance Aqa2 主题

-

Cash Flow Aqa3 主题

-

Financial Terms And Calculations Aqa4 主题

-

Analysing The Financial Performance Of A Business Aqa5 主题

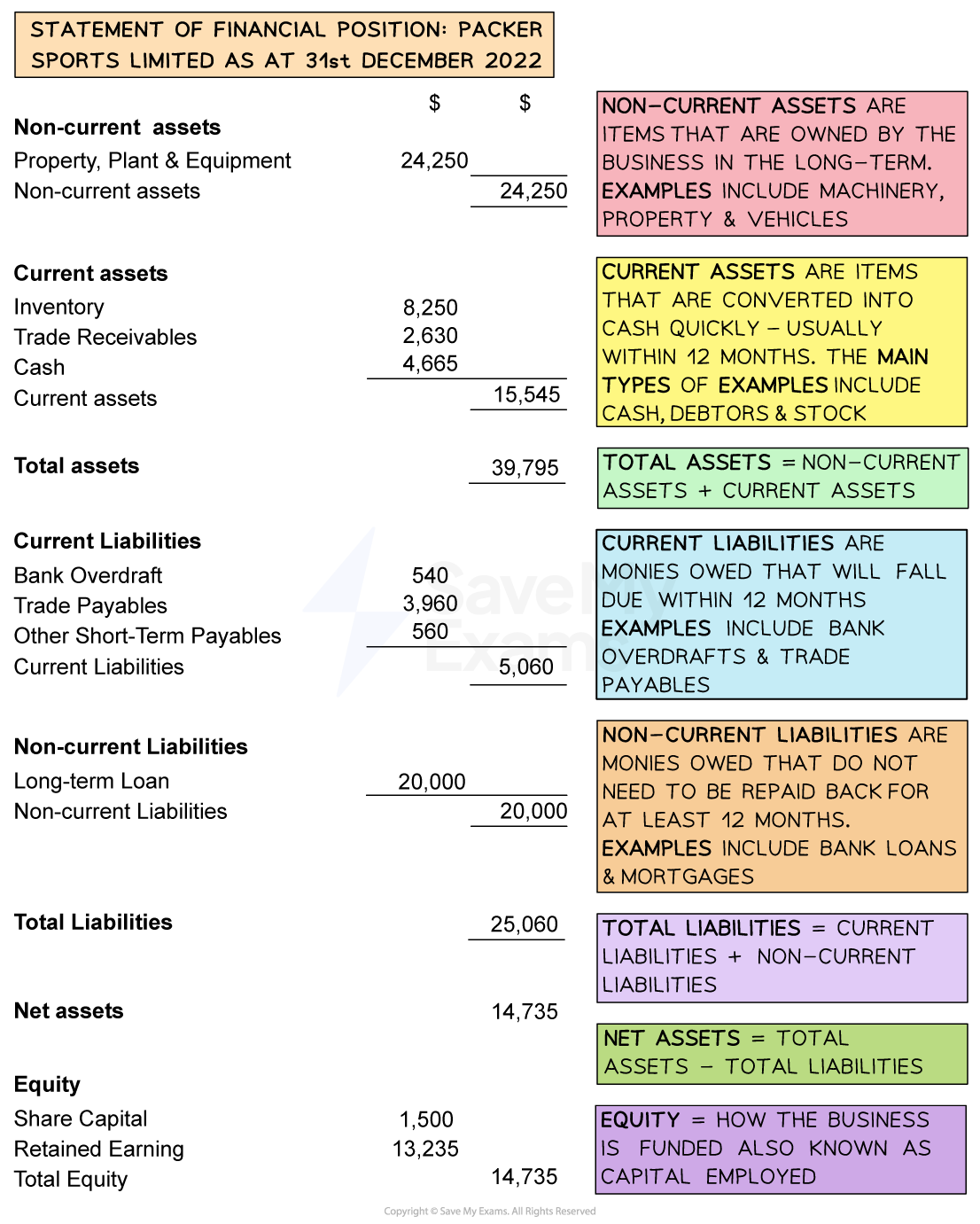

The Statement Of Financial Position aqa

Exam code:8132

Assets and liabilities

Assets

-

Assets are items that are owned by a business

-

Two types of assets appear in the statement of financial position

-

Non-Current Assets are items owned by the business in the long-term

-

Examples include tangible assets such as buildings, land, machinery and vehicles

-

Non-current assets may be intangible such as patents, goodwill or brand value

-

-

Current Assets include cash and items that can be turned into cash relatively quickly, usually within 12 months

-

The four types of current assets are cash in hand, cash in bank, trade receivables and inventory

-

-

Liabilities

-

Liabilities are items that are owed by a business

-

Two types of liabilities appear in the statement of financial position

-

Current Liabilities are short-term financial obligations that a business must usually pay within one year, or as demanded by its creditors

-

E.g. Trade payables and bank overdrafts

-

-

Non-current Liabilities are moneys owed by a business that are due to be repaid over a period longer than twelve months

-

E.g. Long term loans and mortgages

-

-

Structure of the statement of financial position

-

The Statement of Financial Position shows the financial structure of a business at a specific point in time

-

It is included as a key financial statement in the annual report

-

-

It identifies a businesses assets and liabilities and specifies the capital (equity) used to fund the business operations

-

The Statement of Financial Position is sometimes known as the Balance Sheet

-

It is called the balance sheet as the net assets are equal to the total equity

-

-

The statement of financial position generally follows the structure shown below

Statement of financial position

Interpreting the statement of financial position

-

Several deductions can be made from the statement about how a business finances its activities,

Financing its activities

-

Packer Sports Limited is funded through share capital of $1,500 and retained earnings of $13,235

-

The business has long-term liabilities in the form of a loan for $20,000

-

This is significantly greater than share capital so its gearing is high

-

Future applications for loans may be declined as the business is likely to be seen as a lending risk

-

-

What the business owns

-

On the stated date, Packer Sports Ltd owned assets worth $39,795 in total

-

Non-current assets of $24,250 consisting of property, machinery (plant) and other equipment

-

Current assets worth $15,545, comprised of inventory, trade receivables and cash

-

Inventory will be sold and converted to cash or trade receivables

-

-

When trade payables pay their invoices they will become cash

-

What the business owes

-

On the stated date, the business had total liabilities of $25,060

-

Its current liabilities were $5,060, comprised of a bank overdraft, trade payables and other short-term loans

-

Its long-term liabilities were valued at $20,000

-

Examiner Tips and Tricks

You are not required to construct a statement of financial position in the exam, but you may be asked to define assets and liabilities or identify the statement’s uses and key components.

Responses