Exam code:9609

An introduction to sources of finance

-

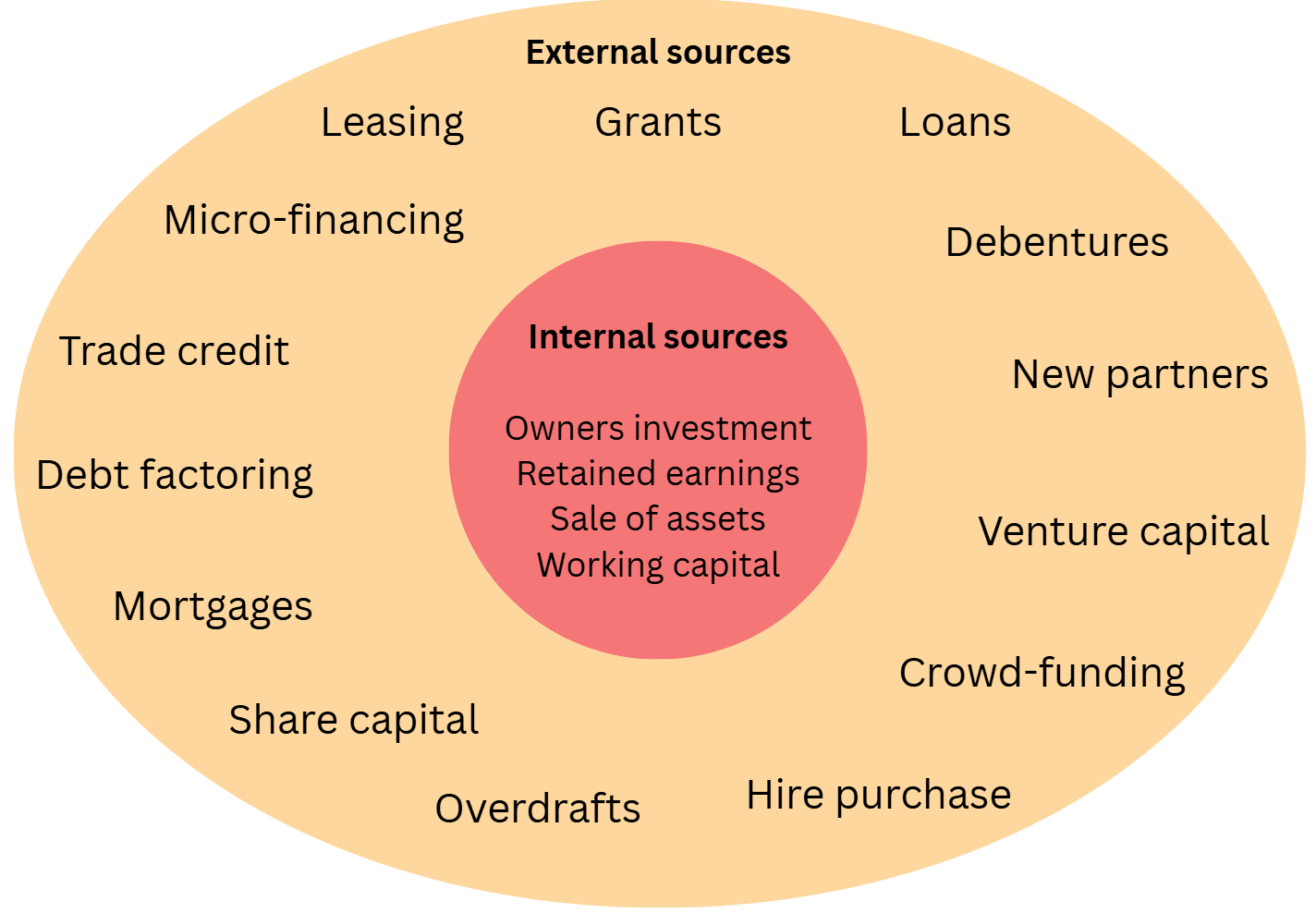

Businesses have different sources of finance available to them

-

When the finance comes from inside the business, it is called an internal source of finance

-

When the finance comes from outside the business, it is called an external source of finance

-

Internal and external sources of finance

Owner’s investment

-

Owners’ investment is a key source of funds when a business starts up

-

Owners may introduce their savings or another lump sum, e.g. money received following a redundancy

-

-

Owners may invest more as the business grows or if there is a specific need, e.g. a short-term cash-flow problem

Evaluating owner’s investment

|

Advantages |

Disadvantages |

|---|---|

|

|

Retained earnings

-

This is profit generated in previous years and not distributed to owners that is reinvested in the business

-

This is a cheap source of finance, as it does not involve borrowing and associated interest and arrangement fees

-

The opportunity cost of investing the money back into the business is that shareholders do not receive extra profit for their investments

Evaluating the use of retained earnings

|

Advantages |

Disadvantages |

|---|---|

|

|

Sale of unwanted assets

-

Selling fixed assets that are no longer required, such as machinery, land or buildings, generates finance

-

Businesses use this method for a range of reasons

-

To raise cash quickly without taking on debt

-

To free up capital tied up in unused or outdated assets

-

To support short-term cash flow needs or fund new investment

-

Evaluating raising finance by selling unwanted assets

|

Advantages |

Disadvantages |

|---|---|

|

|

Sale and leaseback of non-current assets

-

A non-current asset is an interchangeable term with fixed asset

-

A sale and leaseback arrangement may be made if a business wants to continue to use an asset but needs cash

-

The business sells an asset, such as a building, for which it receives cash

-

The business then rents the asset from the new owners or a specialist leasing company

-

E.g. in early 2023, Sainsbury’s announced that it was in talks to sell some of its prime retail property for £500m, which it would then lease back from the new owners, LXi Reit

-

-

Evaluating sale and leaseback of non-current assets

|

Advantages |

Disadvantages |

|---|---|

|

|

Working capital

-

Working capital is the money a business has available for day-to-day operations, such as paying wages, suppliers, and utility bills

-

A business can adjust the way it manages working capital to free up cash and improve its short-term financial position without needing to borrow money

-

Delaying payment to suppliers gives the business more time to hold onto cash

-

Reducing stock levels means less money is tied up in unsold goods

-

Speeding up payments from customers brings in cash more quickly

-

Using existing cash reserves to cover expenses

-

Evaluating working capital as a source of finance

|

Advantages |

Disadvantages |

|---|---|

|

|

-

Further notes on managing working capital can be reviewed here

Internal sources of finance and business ownership

-

The type of business ownership, such as a sole trader, partnership, or limited company, can influence which internal sources of finance are available and suitable

-

Sole traders and partnerships tend to rely more on owner’s investment and working capital because they often have limited retained profit and fewer fixed assets to sell

-

Case Study

Ali’s Mobile Repairs

-

Ali’s Mobile Repairs is a small sole trader business based in Nairobi

-

Ali needs money to buy new tools but doesn’t want to take out a loan

-

As a sole trader, he decides to use his own savings (owners’ investment) and delays a stock order by a week to free up some working capital

-

Companies are more likely to use retained profit, sale of fixed assets, or sale and leaseback, as they operate on a larger scale and have more internal resources

Case Study

Ecosap Ltd

Responses