Business AS CIE

-

enterprise as6 主题

-

business-structure as6 主题

-

business-structure the-different-business-and-economic-sectors

-

business-structure business-ownership-sole-traders-and-partnerships

-

business-structure business-ownership-companies

-

business-structure business-ownership-co-ops-and-social-enterprises

-

business-structure business-ownership-franchises-and-joint-ventures

-

business-structure choosing-the-right-business-ownership

-

business-structure the-different-business-and-economic-sectors

-

size-of-business as3 主题

-

business-objectives as3 主题

-

stakeholders-in-a-business as2 主题

-

human-resource-management as8 主题

-

human-resource-management the-role-of-hrm

-

human-resource-management workforce-planning

-

human-resource-management recruitment

-

human-resource-management selection-and-employment-contracts

-

human-resource-management redundancy-and-dismissal

-

human-resource-management employee-morale-and-welfare

-

human-resource-management training-and-development

-

human-resource-management management-and-workforce-relations

-

human-resource-management the-role-of-hrm

-

motivation as4 主题

-

management as2 主题

-

the-nature-of-marketing as7 主题

-

the-nature-of-marketing the-role-of-marketing

-

the-nature-of-marketing demand-and-supply

-

the-nature-of-marketing markets

-

the-nature-of-marketing consumer-and-industrial-marketing

-

the-nature-of-marketing mass-marketing-and-niche-marketing

-

the-nature-of-marketing market-segmentation

-

the-nature-of-marketing customer-relationship-marketing

-

the-nature-of-marketing the-role-of-marketing

-

market-research as3 主题

-

the-marketing-mix as6 主题

-

the-nature-of-operations as3 主题

-

inventory-management as2 主题

-

capacity-utilisation-and-outsourcing as1 主题

-

business-finance as2 主题

-

sources-of-finance as3 主题

-

forecasting-and-managing-cash-flows as1 主题

-

costs as4 主题

-

budgets as1 主题

forecasting-and-managing-cash-flows cash-flow-forecasts

Exam code:9609

The meaning and purpose of cash flow forecasts

-

A cash flow forecast is a prediction of the anticipated cash inflows and outflows, usually for a six- to twelve-month period

-

Cash inflows include income from sales, loan sums received from the bank, interest received or capital injected into a business by owners

-

Cash outflows include payments for stock, staff wages and salaries, rent and utility bills and repayments of bank loans

-

Examiner Tips and Tricks

You may be asked to identify an example of a cash inflow or a cash outflow from a list

Inflows can be remembered using the acronym SLIC (Sales, Loans, Interest, Capital) while outflows can be remembered using the acronym SWURRS (Stock, Wages, Utilities, Rent, Repayments Salaries)

-

A detailed business plan usually includes a cash flow forecast

-

It provides evidence for investors or lenders that finance is required

-

It allows owners or managers to make plans to cover cash shortfalls

-

-

Cash flow forecasts are particularly useful in the following situations:

-

Starting up a business

-

Identifying how much cash is needed in the first few months

-

-

Running an existing business

-

Recognising where a fall in sales may require use of an overdraft facility

-

-

Supporting applications for borrowing

-

Determining the size of loan or overdraft needed, when and for how long it is needed and by when it is likely to be fully repaid

-

-

Managing transactions

-

Identifying how much or how little cash is deposited at the bank can determine when bills should be paid

-

-

Interpreting cash flow forecasts

-

The cash flow forecast structure

-

Compiles expected cash inflows and cash outflows, month by month,

-

Takes into account cash present at the beginning of the period

-

Determines the cash flow position at the end of each month over a period of time

-

-

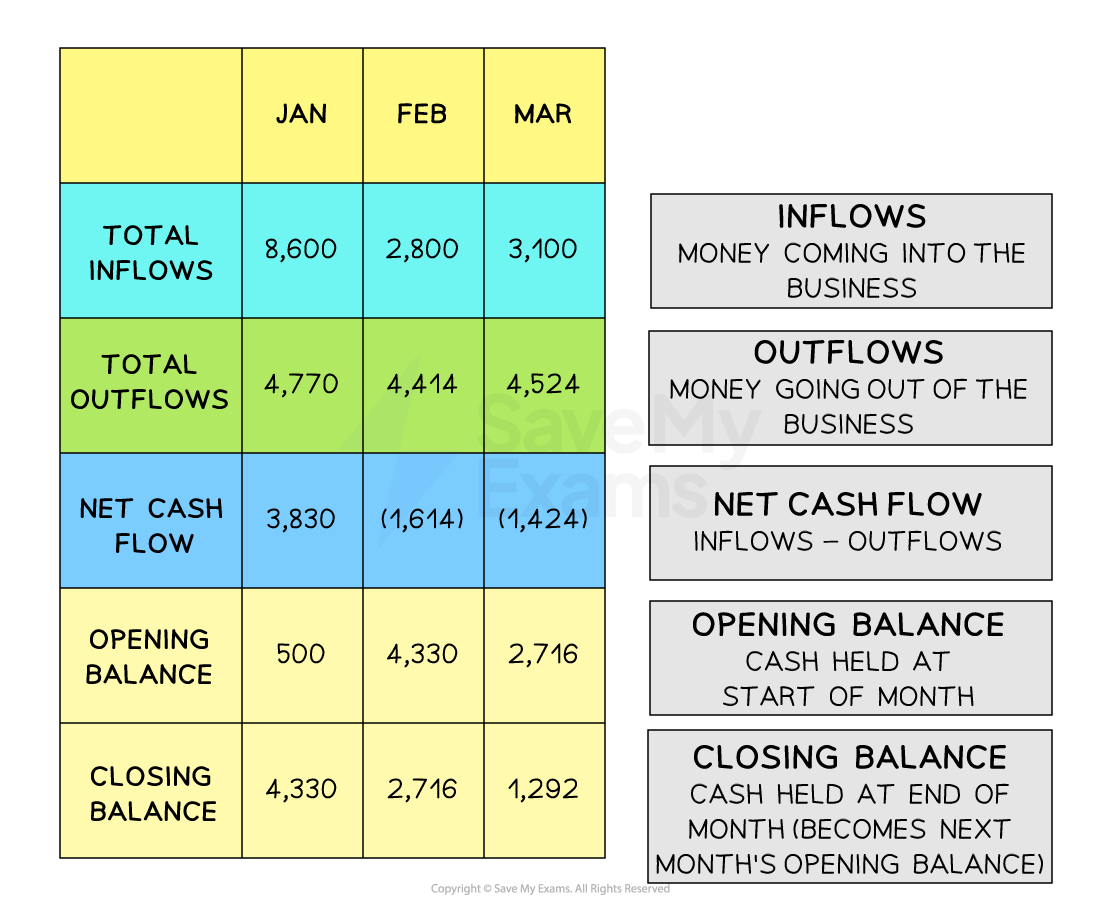

Although the layout can vary, a typical cash flow forecast includes each of the key elements

Example three-month cash flow forecast

Key terminology

-

The opening balance is the cash position at the beginning of each month

-

In the first month, this is usually

-

Cash carried forward from any earlier trading

-

Cash introduced by the owner or from loans received

-

-

In later months, the opening balance is the closing balance carried forward from the previous month

-

-

Net cash flow is the difference between cash inflows and cash outflows during a month

Calculating net cash flow

-

The closing balance is the sum of the month’s net cash flow and the opening balance

-

The closing balance is calculated using the formula

-

Calculating and amending cash flow forecasts

-

A business must first gather information about all cash inflows and cash outflows it expects to encounter over the period

-

The following steps should then be taken to construct the cash flow forecast

Step 1: Calculate total cash inflows

-

In this instance, the business expects to receive cash inflows from sales in March, April and May

-

Owners’ capital of €6,000 will be introduced in March

-

The total for each month is calculated by adding cash from sales to capital introduced

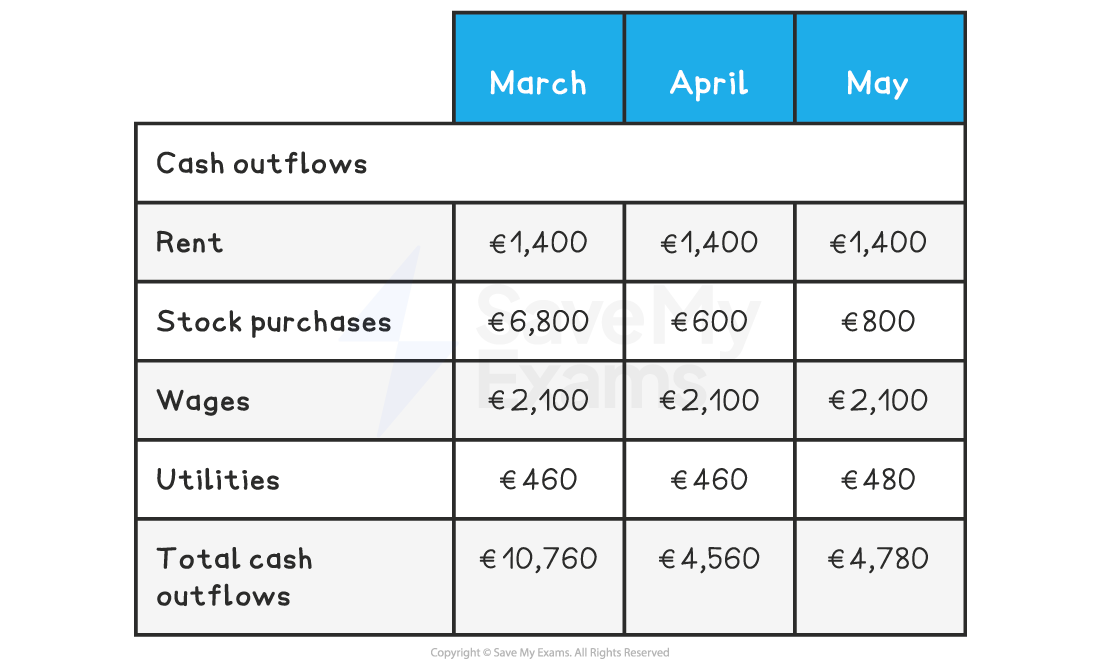

Step 2: Calculate total cash outflows

-

In this instance, the business expects to pay rent of €1,400 in March, April and May

-

It will purchase a significant amount of stock in March, with smaller amounts in April and May

-

Wages

Responses