Exam code:9609

Why do businesses need finance?

-

Businesses need finance to get started, allow them to grow and fund continuing activity

-

Finance may be needed for capital expenditure, which is spending on fixed assets such as equipment, buildings, IT equipment and vehicles

-

Similarly, finance is required for operating expenditure, spending on raw materials or day-to-day expenses, such as wages or utilities

-

Why business finance is needed

1. Start-up finance

-

Start-up finance funds fixed assets and current assets such as inventory before a business can begin trading

-

The amount needed is identified in the business plan

-

Owners often invest their own capital into a new business

-

Some small new business owners obtain a start-up loan to cover initial costs

-

2. Finance for growth

-

As a business grows, it may need to purchase capital equipment

-

It may require more machinery, buildings, IT infrastructure or vehicles, which help the business to increase output

-

-

If a business wants to grow by developing new products, large amounts may need to be invested in research and development (R&D)

-

E.g. Apple‘s annual R&D expenses for 2023 were $29.915bn, a 13.96% increase from 2022, to invest heavily in artificial intelligence (AI) and product innovation

-

3. Working capital

-

Finance is required for working capital, day-to-day spending on raw materials, wages or utilities

-

Having a steady flow of working capital is essential

-

Without working capital, the business would be unable to cover its regular expenses

-

It may suffer cash-flow problems, which could lead to business failure

-

Short-term and long-term finance needs

Short-term finance needs

-

Short-term sources of finance are needed to meet regular costs such as paying for utilities, suppliers and employee wages

-

They are likely to be relatively small amounts and are rarely needed beyond a year

-

-

Important short-term finance needs include marketing costs and recruitment costs

-

These are closely linked to short-term business objectives

-

-

Where revenue from sales does not cover these expenses, sources such as overdrafts or trade credit may be useful

Long-term finance needs

-

Longer-term sources of finance are needed to fund the purchase of non-current assets such as buildings and other types of capital resources or to acquire other businesses

-

These are likely to be large sums that may be required for a significant period of time

-

-

Where retained profit is not sufficient to meet these needs, businesses may consider taking out long-term loans, mortgages or raising share capital

Cash versus profit

-

Profit is the difference between revenue generated and total business costs during a specific period of time

-

Profit is an important indicator of a company’s financial health and long-term sustainability, as it helps to assess the effectiveness of a company’s operations

-

-

Cash is measured by taking into account the full range of money flowing in and out of a business

-

This includes revenue from sales, operating expenses, investments, loans, and any other cash-related transactions

-

It performs a variety of functions in a business

-

It is used to cover regular operating expenses such as workers’ pay, supplier invoices and overheads such as rent and utility bills

-

It can also be used to meet unexpected expenses, such as the replacement of broken equipment

-

-

Profit versus cash flow

-

While a business may ultimately make a profit, they may lack cash at times

-

Some customers may not have paid them yet

-

They may have paid some large bills

-

-

Cash-poor businesses will struggle to pay suppliers, employees and operating expenses

-

This is called insolvency

-

Lifestyle retailer Joules announced plans to liquidate in December 2022 as a result of cash-flow difficulties, despite making a profit of £2.6 million during the previous year

-

-

Business failure and finance

-

Financial problems are one of the most common causes of business failure, especially for small and new businesses

-

Without sufficient finance, even a business with effective financial planning, good products and healthy demand may fail due to poor cash flow or unpaid debts

-

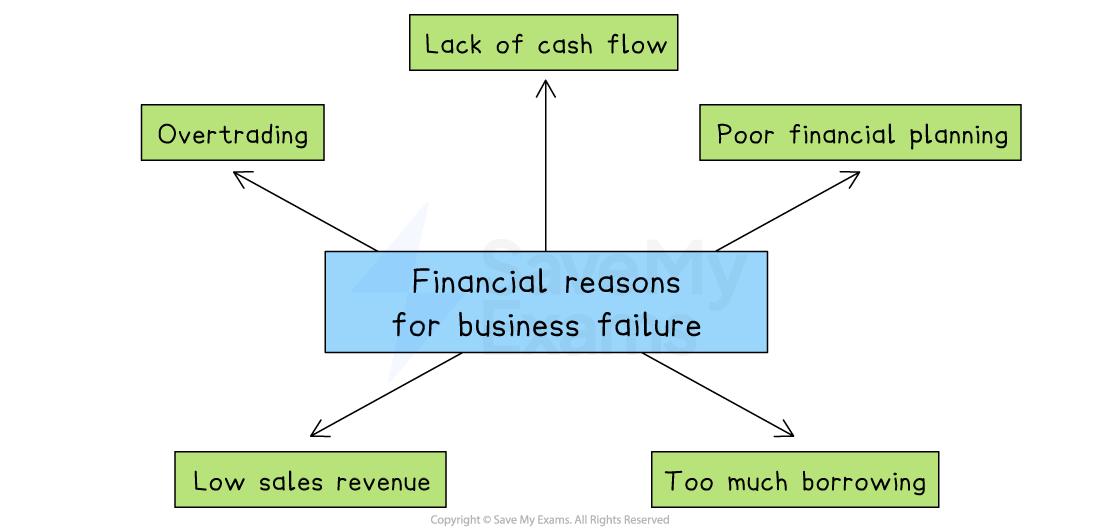

Financial reasons for business failure

Lack of cash flow

-

A business may be profitable on paper but still run out of cash

-

If customers delay payments or unexpected bills arise, the business may not have enough money to pay suppliers or wages

Poor financial planning

-

If a business does not forecast cash flow accurately or budget properly, it may overspend or run out of money

-

Poor planning can lead to missed loan repayments or unpaid bills

Too much borrowing

-

Relying heavily on loans or overdrafts increases pressure on the business to make regular repayments

-

High interest costs can add to financial stress, especially if revenue falls

Low sales revenue

-

If the business is not generating enough income from sales, it may not cover its costs

-

This is a particular risk if demand is seasonal, falls unexpectedly or pricing is too low

Overtrading

-

This happens when a business grows too quickly without enough capital to support its expansion

-

It may take on large orders or open new branches but run out of cash before it receives payments from customers

Responses