Exam code:9609

An introduction to budgets

-

A budget is a financial plan that a business (or department in the business) sets regarding costs and revenue

-

The budget is usually closely aligned with the business objectives

-

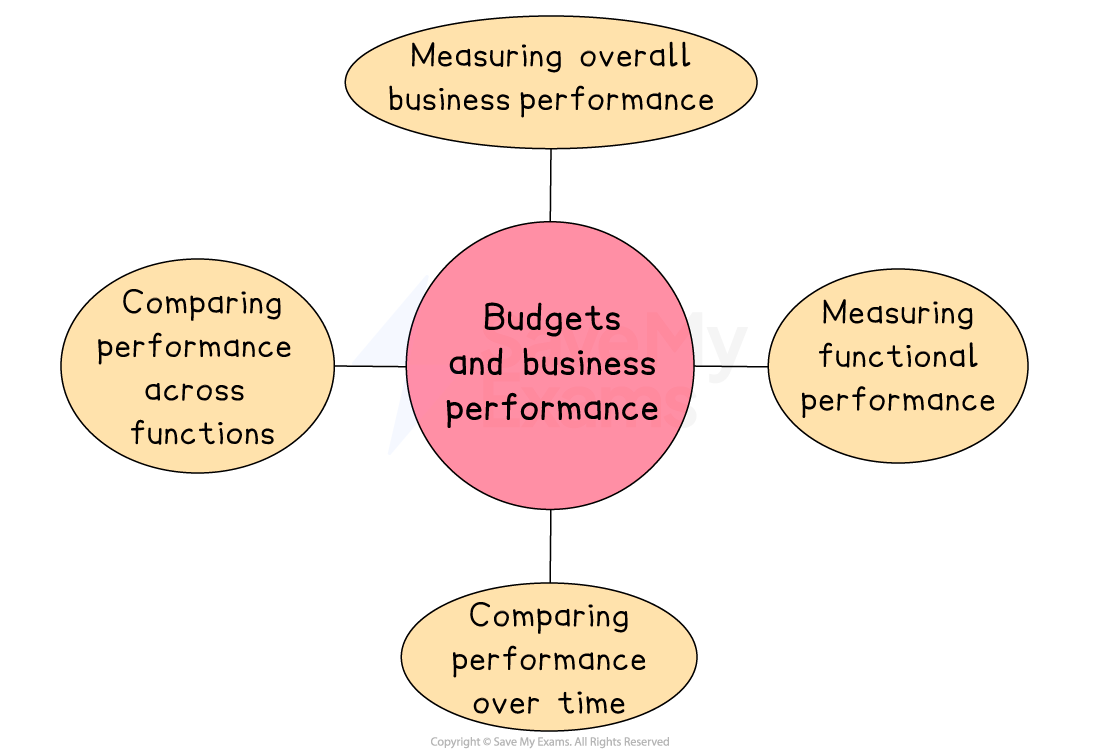

Measuring performance with budgets

Measuring overall business performance

-

Budgets allow managers to assess how well the whole business is performing

-

Compare actual income and expenses with budgeted figures to identify profit levels, cost control, or overspending

-

Helps judge if the business is meeting its financial goals, such as revenue targets or profit margins

-

Variances help explain good or poor performance

-

Measuring functional performance

-

Each function, e.g. marketing, operations, HR, usually has its own budget

-

Comparing actual department spending and results with the budget shows how well each area is performing

-

Helps hold managers accountable for cost control and meeting targets

-

Encourages efficient use of resources within each function

-

Comparing performance over time

-

Budgets help track performance year-on-year or month-on-month

-

Businesses can spot trends, such as rising costs or improving efficiency

-

Helps with long-term planning and forecasting

Comparing performance across functions

-

Budgets help compare different departments at the same time, even if their roles are different

-

This supports fair decision-making on things like bonuses, promotions or extra funding

Types of budgets

1. Incremental budgets

-

An incremental budget is based on last year’s figures, with small adjustments made to reflect expected changes

-

Changes could include inflation, wage rises or modest increases in sales and costs

-

Evaluating the use of incremental budgets

|

Advantages |

Disadvantages |

|---|---|

|

|

|

|

2. Flexible budgets

-

A flexible budget is adjusted depending on the level of output or sales

-

Instead of using one fixed figure, it shows what income and expenses should look like at different levels of activity

-

Evaluating the use of flexible budgets

|

Advantages |

Disadvantages |

|---|---|

|

|

|

|

3. Zero budgeting

-

Zero budgeting is when every department or manager must justify all spending

-

Rather than using the previous year’s budget as a starting point, each cost must be reviewed and approved individually

-

Evaluating the use of zero budgeting

|

Advantages |

Disadvantages |

|---|---|

|

|

|

|

The use of budgets

-

Budgets can play an important role in the day-to-day management of a business

-

They help with planning, decision-making, control, and monitoring of non-financial performance

Ways budgets are used

Allocating resources

-

Budgets help businesses decide where money and resources should be focused

-

Each department receives funding based on its needs and priorities, ensuring efficient use

Control within a business

-

Budgets set clear financial limits to help prevent overspending

-

Managers are accountable for staying within their budget, which improves discipline and control

Monitoring non-financial performance

-

Budgets can track spending on non-financial goals like customer service, training, or sustainability

-

This ensures resources support wider business objectives

Variances

-

Once budgets have been set, managers carry out variance analysis to compare actual performance to the targets set in the budget

-

A budget variance is a difference between the figure budgeted and the actual figure achieved by the end of the budgetary period

-

-

Variance analysis seeks to determine the reasons for the differences between the actual figures and the budgeted figures

Types of variance

|

Favourable (F) |

Adverse (A) |

|---|---|

|

|

Calculating and interpreting variances

-

A budget variance is calculated by subtracting the budgeted figure from the actual figure

<img alt=”space Cost space variance space equals space Actual space cost space minus space Budgeted space cost” data-mathml=”<math ><semantics><mrow><mo> </mo><mi>Cost</mi><mo> </mo><mi>variance</mi><mo> </mo><mo>=</mo><mo> </mo><mi>Actual</mi><mo> </mo><mi>cost</mi><mo> </mo><mo>-</mo><mo> </mo><mi>Budgeted</mi><mo> </mo><mi>cost</mi></mrow><annotation encoding=”application/vnd.wiris.mtweb-params+json”>{“fontFamily”:”Times New Roman”,”fontSize”:”18″,”autoformat”:true,”toolbar”:”<toolbar ref=’general’><tab ref=’general’><removeItem ref=’setColor’/><removeItem ref=’bold’/><removeItem ref=’italic’/><removeItem ref=’autoItalic’/><removeItem ref=’setUnicode’/><removeItem ref=’mtext’ /><removeItem ref=’rtl’/><removeItem ref=’forceLigature’/><removeItem ref=’setFontFamily’ /><removeItem ref=’setFontSize’/></tab></toolbar>”}</annotation></semantics></math>” height=”22″ role=”math” src=”data:image/svg+xml;charset=utf8,%3Csvg%20xmlns%3D%22http%3A%2F%2Fwww.w3.org%2F2000%2Fsvg%22%20xmlns%3Awrs%3D%22http%3A%2F%2Fwww.wiris.com%2Fxml%2Fmathml-extension%22%20height%3D%2222%22%20width%3D%22336%22%20wrs%3Abaseline%3D%2216%22%3E%3C!–MathML%3A%20%3Cmath%20xmlns%3D%22http%3A%2F%2Fwww.w3.org%2F1998%2FMath%2FMathML%22%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmi%3ECost%3C%2Fmi%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmi%3Evariance%3C%2Fmi%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmo%3E%3D%3C%2Fmo%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmi%3EActual%3C%2Fmi%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmi%3Ecost%3C%2Fmi%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmo%3E-%3C%2Fmo%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmi%3EBudgeted%3C%2Fmi%3E%3Cmo%3E%26%23xA0%3B%3C%2Fmo%3E%3Cmi%3Ecost%3C%2Fmi%3E%3C%2Fmath%3E–%3E%3Cdefs%3E%3Cstyle%20type%3D%22text%2Fcss%22%3E%40font-face%7Bfont-family%3A’math143f4d31b04031e49f5eb18baba’%3Bsrc%3Aurl(data%3Afont%2Ftruetype%3Bcharset%3Dutf-8%3Bbase64%2CAAEAAAAMAIAAAwBAT1MvMi7iBBMAAADMAAAATmNtYXDEvmKUAAABHAAAADxjdnQgDVUNBwAAAVgAAAA6Z2x5ZoPi2VsAAAGUAAAA%2FGhlYWQQC2qxAAACkAAAADZoaGVhCGsXSAAAAsgAAAAkaG10eE2rRkcAAALsAAAADGxvY2EAHTwYAAAC%2BAAAABBtYXhwBT0FPgAAAwgAAAAgbmFtZaBxlY4AAAMoAAABn3Bvc3QB9wD6AAAEyAAAACBwcmVwa1uragAABOgAAAAUAAADSwGQAAUAAAQABAAAAAAABAAEAAAAAAAAAQEAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAACAgICAAAAAg1UADev96AAAD6ACWAAAAAAACAAEAAQAAABQAAwABAAAAFAAEACgAAAAGAAQAAQACAD0iEv%2F%2FAAAAPSIS%2F%2F%2F%2FxN3wAAEAAAAAAAAAAAFUAywAgAEAAFYAKgJYAh4BDgEsAiwAWgGAAoAAoADUAIAAAAAAAAAAKwBVAIAAqwDVAQABKwAHAAAAAgBVAAADAAOrAAMABwAAMxEhESUhESFVAqv9qwIA%2FgADq%2FxVVQMAAAIAgADrAtUCFQADAAcAZRgBsAgQsAbUsAYQsAXUsAgQsAHUsAEQsADUsAYQsAc8sAUQsAQ8sAEQsAI8sAAQsAM8ALAIELAG1LAGELAH1LAHELAB1LABELAC1LAGELAFPLAHELAEPLABELAAPLACELADPDEwEyE1IR0BITWAAlX9qwJVAcBV1VVVAAEAgAFVAtUBqwADADAYAbAEELEAA%2FawAzyxAgf1sAE8sQUD5gCxAAATELEABuWxAAETELABPLEDBfWwAjwTIRUhgAJV%2FasBq1YAAQAAAAEAANV4zkFfDzz1AAMEAP%2F%2F%2F%2F%2FWOhNz%2F%2F%2F%2F%2F9Y6E3MAAP8gBIADqwAAAAoAAgABAAAAAAABAAAD6P9qAAAXcAAA%2F7YEgAABAAAAAAAAAAAAAAAAAAAAAwNSAFUDVgCAA1YAgAAAAAAAAAAoAAAAsgAAAPwAAQAAAAMAXgAFAAAAAAACAIAEAAAAAAAEAADeAAAAAAAAABUBAgAAAAAAAAABABIAAAAAAAAAAAACAA4AEgAAAAAAAAADADAAIAAAAAAAAAAEABIAUAAAAAAAAAAFABYAYgAAAAAAAAAGAAkAeAAAAAAAAAAIABwAgQABAAAAAAABABIAAAABAAAAAAACAA4AEg

Responses