Business AS AQA

-

1-1-the-nature-and-purpose-of-business as3 主题

-

1-2-forms-of-business as5 主题

-

1-3-the-external-environment as5 主题

-

2-1-management-and-leadership as3 主题

-

2-2-management-decision-making as4 主题

-

2-3-the-role-and-importance-of-stakeholders as3 主题

-

3-1-marketing-objectives as1 主题

-

3-2-understanding-markets-and-customers as5 主题

-

3-3-making-marketing-decisions as2 主题

-

3-4-the-marketing-mix as7 主题

-

4-1-operational-objectives as2 主题

-

4-2-operational-performance as1 主题

-

4-3-efficiency-and-productivity as3 主题

-

4-4-quality as1 主题

-

4-5-inventory-and-supply-chain-management as3 主题

-

5-1-financial-objectives as2 主题

-

5-2-financial-performance as6 主题

-

5-3-sources-of-finance as3 主题

-

5-4-cash-flow-and-profit as1 主题

-

6-1-human-resource-objectives as1 主题

-

6-2-human-resource-performance as1 主题

-

6-3-organisational-design as3 主题

-

6-4-human-resource-planning as4 主题

-

6-5-motivation as1 主题

-

6-6-improving-employer-employee-relations as2 主题

break-even-analysis as

Exam code:7131

The value of break-even analysis

-

Break-even analysis is a financial tool used to determine the point at which the business revenue equals its expenses, resulting in neither profit nor loss

-

It helps businesses understand the minimum level of sales or output they need to achieve to cover all costs

-

This helps managers make informed decisions about pricing and production volumes

-

-

It is particularly useful for communicating with stakeholders, including investors or lenders

-

It demonstrates the financial viability of the business and gives an insight into potential return on investment

-

Revenue and costs

-

Break-even analysis takes into account three main components

The components of break-even analysis

Sales revenue

-

Sales revenue is the value of the units sold by a business over a period of time

-

E.g. the revenue earned by Apple Music from sales of music downloads

-

Sales revenue is a key business performance measure and must be calculated to identify profit

-

Sales revenue is calculated using the formula

-

Sales revenue increases as the sales volume increases

-

Costs

-

In preparing goods and services for sale, businesses incur a range of costs

-

Some examples of these costs include purchasing raw materials, paying staff salaries and wages and paying utility bills, such as electricity

-

-

These costs can be broken into different categories

-

Fixed costs (FC) are costs that do not change as the level of output changes

-

These have to be paid whether the output is zero or 5,000

-

-

Variable costs (VC) are costs that vary directly with the output

-

These increase as output increases and vice versa

-

-

Total costs (TC) are the sum of the fixed and variable costs

-

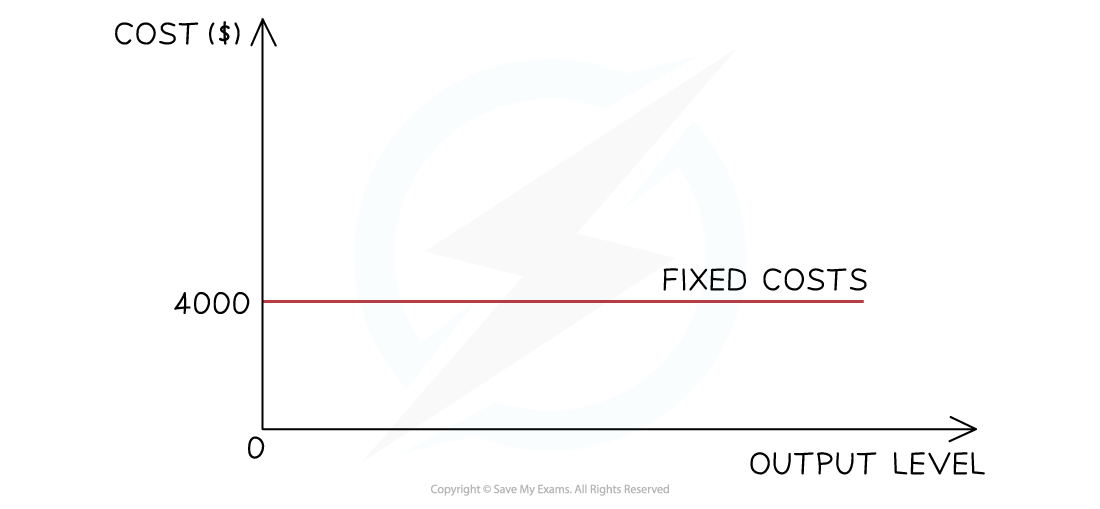

Fixed costs

-

The firm has to pay its fixed costs, which do not change, irrespective of whether the output is zero or 100,000 units

-

The fixed costs for this firm are $4,000

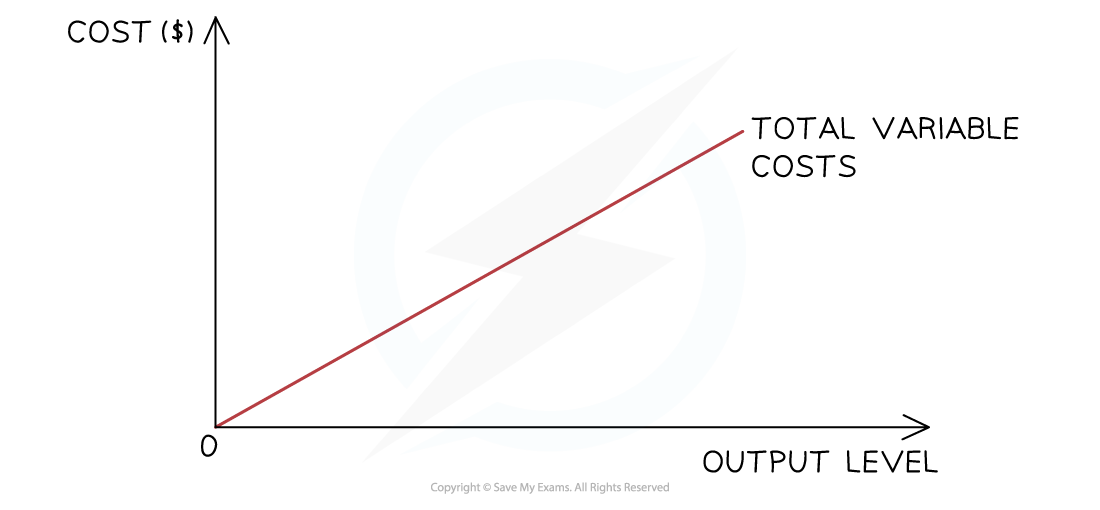

Variable costs

-

The variable costs initially rise proportionally with output, as shown in the diagram

-

At some point, the firm will benefit from a purchasing economy of scale, and the rise will no longer be proportional

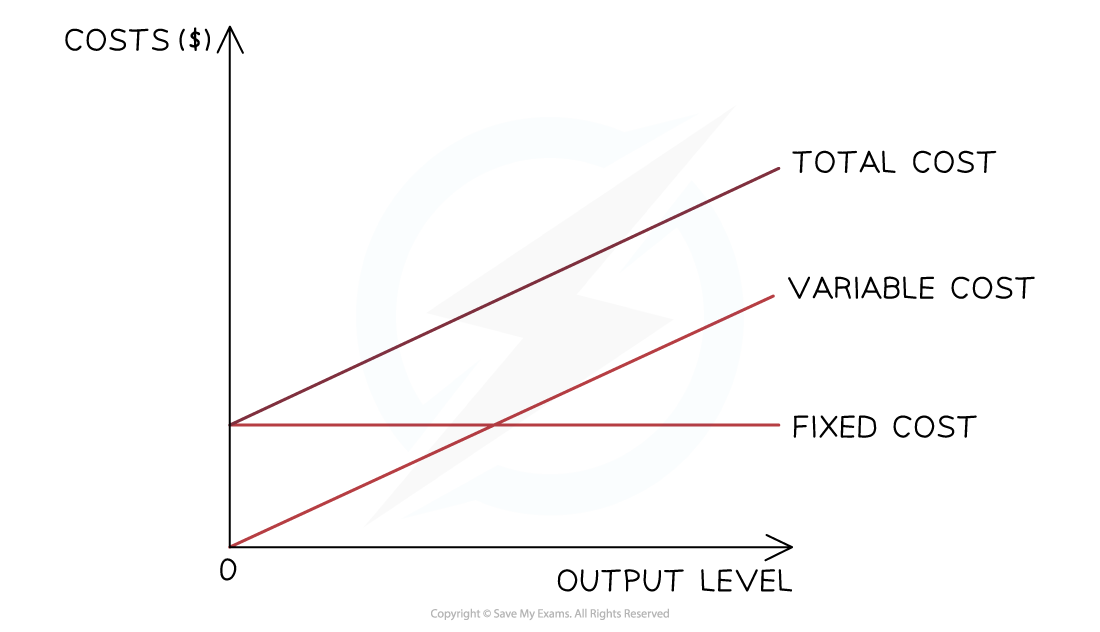

Total costs

-

The total costs are the sum of the variable and fixed costs at each level of output

-

Total costs cannot be zero, as all firms have some level of fixed costs

Constructing and interpreting breakeven charts

-

A breakeven chart is a visual representation of the breakeven point and is used to identify the following:

-

Fixed costs, total costs and revenue over a range of output

-

The breakeven point — where total costs are equal to revenue

-

Profit or loss made at each level of output

-

The margin of safety

-

Diagram: Breakeven chart

Responses