Business AS CIE

-

enterprise as6 主题

-

business-structure as6 主题

-

business-structure the-different-business-and-economic-sectors

-

business-structure business-ownership-sole-traders-and-partnerships

-

business-structure business-ownership-companies

-

business-structure business-ownership-co-ops-and-social-enterprises

-

business-structure business-ownership-franchises-and-joint-ventures

-

business-structure choosing-the-right-business-ownership

-

business-structure the-different-business-and-economic-sectors

-

size-of-business as3 主题

-

business-objectives as3 主题

-

stakeholders-in-a-business as2 主题

-

human-resource-management as8 主题

-

human-resource-management the-role-of-hrm

-

human-resource-management workforce-planning

-

human-resource-management recruitment

-

human-resource-management selection-and-employment-contracts

-

human-resource-management redundancy-and-dismissal

-

human-resource-management employee-morale-and-welfare

-

human-resource-management training-and-development

-

human-resource-management management-and-workforce-relations

-

human-resource-management the-role-of-hrm

-

motivation as4 主题

-

management as2 主题

-

the-nature-of-marketing as7 主题

-

the-nature-of-marketing the-role-of-marketing

-

the-nature-of-marketing demand-and-supply

-

the-nature-of-marketing markets

-

the-nature-of-marketing consumer-and-industrial-marketing

-

the-nature-of-marketing mass-marketing-and-niche-marketing

-

the-nature-of-marketing market-segmentation

-

the-nature-of-marketing customer-relationship-marketing

-

the-nature-of-marketing the-role-of-marketing

-

market-research as3 主题

-

the-marketing-mix as6 主题

-

the-nature-of-operations as3 主题

-

inventory-management as2 主题

-

capacity-utilisation-and-outsourcing as1 主题

-

business-finance as2 主题

-

sources-of-finance as3 主题

-

forecasting-and-managing-cash-flows as1 主题

-

costs as4 主题

-

budgets as1 主题

costs approaches-to-costing

Exam code:9609

An introduction to costing

-

Businesses can choose how to calculate the costs of manufacturing products, accounting for

-

Direct costs, such as raw materials, components and direct labour

-

Indirect costs, including overheads such as rent, rates, selling costs and administration expenses

-

-

Two of the most commonly used methods are

-

Full costing

-

This method allocates all costs, direct and indirect, equally across all products a business manufactures

-

-

Contribution costing

-

This method allocates only direct costs to products manufactured by a business

-

Indirect costs are covered and profits generated by contribution

-

-

The principles of full costing

-

If a business manufactures one type of product, full costing can be used to allocate all costs, direct and indirect, equally across all products

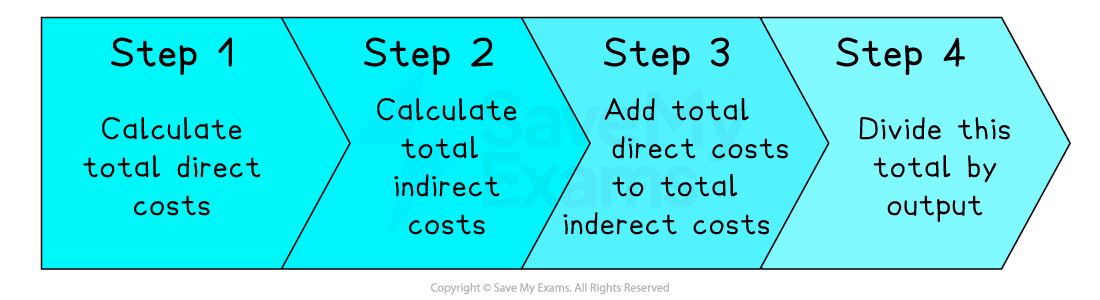

Stages in full Costing

Worked Example

Luftig Soft Drinks Gmbh uses full costing to determine the cost of manufacturing each bottle it produces.

In 2023 it manufactured 455,000 bottles of soft drink, and recorded the following costs:

Total Direct Costs €52,300

Total Indirect Costs €120,600

Calculate the full cost of producing each bottle of soft drink.

(2)

Step 1: Add total direct costs to total indirect costs

(1)

Step 2: Divide total costs by output

(1)

-

When a business manufactures more than one product, it needs to decide how to allocate indirect costs across the range of products

-

Each product may incur a different proportion of indirect costs

-

E.g. they may require more workers, machinery or factory space, or may be manufactured in greater volumes

-

-

These decisions are unlikely to be straightforward and should remain constant over time

-

Inappropriate allocation of costs can lead to incorrect pricing decis

-

-

Responses