Exam code:9609

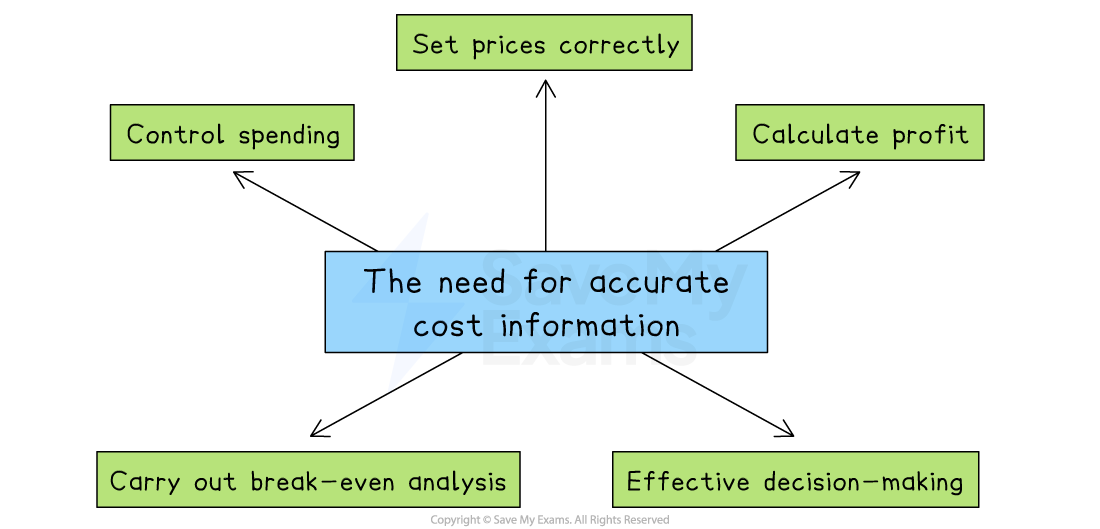

The need for accurate cost information

-

Cost information refers to data about all the costs involved in producing and selling a product

Why is accurate cost information needed?

-

To set prices correctly

-

If a business underestimates its costs, it may set prices too low and make a loss

-

Overestimating costs may lead to prices that are too high, reducing demand

-

-

To calculate profit

-

Accurate costs help calculate gross profit and net profit, important for judging performance

-

-

For decision-making

-

Managers use cost data to decide whether to

-

Launch a new product

-

Continue or stop production

-

Change suppliers or production methods

-

-

-

To carry out break-even analysis

-

This helps decide how many units need to be sold to cover all costs.

-

Accurate costs make break-even analysis more reliable

-

-

To control spending

-

Comparing actual costs with budgets helps identify areas of overspending and take action

-

Types of costs

-

In preparing goods and services for sale, businesses incur a range of costs

-

These costs can be broken into different categories

Fixed costs

-

Fixed costs do not change according to output

-

These have to be paid whether the output is zero or 5,000

-

Examples include rent, management salaries, insurance and bank loan repayments

-

-

Fixed costs in this instance are $4,000

Variable costs

-

Variable costs rise proportionally with output

-

These increase as output rises and decrease as output falls

-

Examples include raw material costs and wages of workers directly involved in production and packaging

-

-

At some point, a business may benefit from a purchasing economies, so the rise will no longer be proportional

Total costs

-

Total costs is the combination of all fixed and variable costs involved in producing a certain level of output

-

Total costs cannot be zero, as all organisations have some level of fixed costs

An alternative way to classify costs

Direct costs

-

These are costs that can be directly traced to a specific product, service, or department

-

They relate specifically and exclusively to the production of a particular item

-

Direct costs can be fixed or variable

-

For example, a one-off licence fee for a software product is a direct fixed cost if it applies only to that product

-

-

Examples of direct costs include:

-

The cost of raw materials used to make a table

-

Wages paid to factory workers assembling a specific product

-

Packaging for a single product line

-

Indirect costs

-

Indirect costs are costs that cannot be traced directly to a specific product, job, or service

-

They support overall operations and are shared across departments or products

-

These costs are necessary for production or business operations, but they are not directly linked to any one unit of output

-

-

Indirect costs can also be fixed or variable

-

For example, the monthly rent paid for a shared office space is an indirect fixed cost, as it supports multiple departments but does not vary with output

-

-

Examples of indirect costs include:

-

Rent and utility bills for a factory or office

-

Salaries of supervisors or administrative staff

-

Office supplies and insurance

-

Depreciation of machinery used across several product lines

-

Comparison: direct vs indirect costs

|

Feature |

Direct costs |

Indirect costs |

|---|---|---|

|

Traceability |

|

|

|

Examples |

|

|

|

Can be fixed or variable? |

|

|

Using cost information to make decisions

-

Cost data helps businesses make key decisions

Total costs (TC)

-

Total costs information can be used to assess how much money is needed to produce at a certain level and is vital for budgeting and cash flow forecasting

Responses