Government Intervention in Markets

-

Nearly every economy in the world is a mixed economy and has varying degrees of government intervention

-

Government intervention is necessary for several reasons

-

Correct market failure: in many markets there is a less than optimal allocation of resources from society’s point of view

-

In maximising their self-interest, firms and individuals will not self-correct this allocation of resources and there is a role for the government

-

They often achieve this by influencing the level of production or consumption

-

-

Earn government revenue: governments need money to provide essential services, public and merit goods

-

Revenue is raised through intervention such as taxation, privatisation, sale of licenses (e.g. 5G licenses), and sale of goods/services

-

-

Promote equity: to reduce the opportunity gap between the rich and poor

-

Support firms: in a global economy, governments choose to support key industries so as to help them remain competitive

-

Support poorer households: poverty has multiple impacts on both the individual and the economy

-

Intervention seeks to redistribute income (tax the rich and give to the poor) so as to reduce the impact of poverty

-

-

Four of the most common methods used to intervene in markets are indirect taxation, use of subsidies, maximum prices, and minimum prices

Indirect taxation

-

An indirect tax can be either ad valorem or specific

Ad Valorem tax

-

Value added tax (VAT) is 20% in the UK in 2024. The more goods/services consumed, the larger the tax bill

-

This causes the second shifted supply curve to diverge from the original supply curve

-

VAT raises significant government revenue. It is the third biggest source of tax revenue after income tax and national insurance in the UK

-

Diagram analysis

-

Initial equilibrium is at P1Q1

-

Supply shifts left due to the tax from S → S + tax

-

The two supply curves diverge as percentage tax means more tax per unit is paid at higher prices

-

-

Consumer incidence of tax is (P2 – P1) x Q2 – Area A

-

Producer incidence of tax is (P1 – P3) x Q2 – Area B

-

New equilibrium is at P2Q2

-

Final price is higher (P2) and QD is lower (Q2)

-

Specific tax on negative externality of production

-

Governments frequently tax firms that pollute or create harmful external costs in production

Diagram analysis

-

The free-market equilibrium is at PeQe – where MSB = MPC

-

Market failure exists as MSC > MSB at equilibrium

-

Optimum level of output is at Qopt

-

There is over-provision of this product

-

-

A specific tax shifts the supply curve left from S → S1

-

The tax does not completely eradicate the welfare loss but moves the market closer to the optimum level of output (Qopt)

-

The welfare loss has been reduced as shown in the diagram

-

-

The new market equilibrium is at P1Q1

-

This is a higher price and less output

-

There is less over-provision and so less market failure

-

The external costs have been reduced

-

-

Governments frequently tax the production of goods and services that create environmental harm or damaging health consequences. Some examples include intensive factory farming, oil drilling, the manufacture of chemicals and the construction of new roads or runways at airports

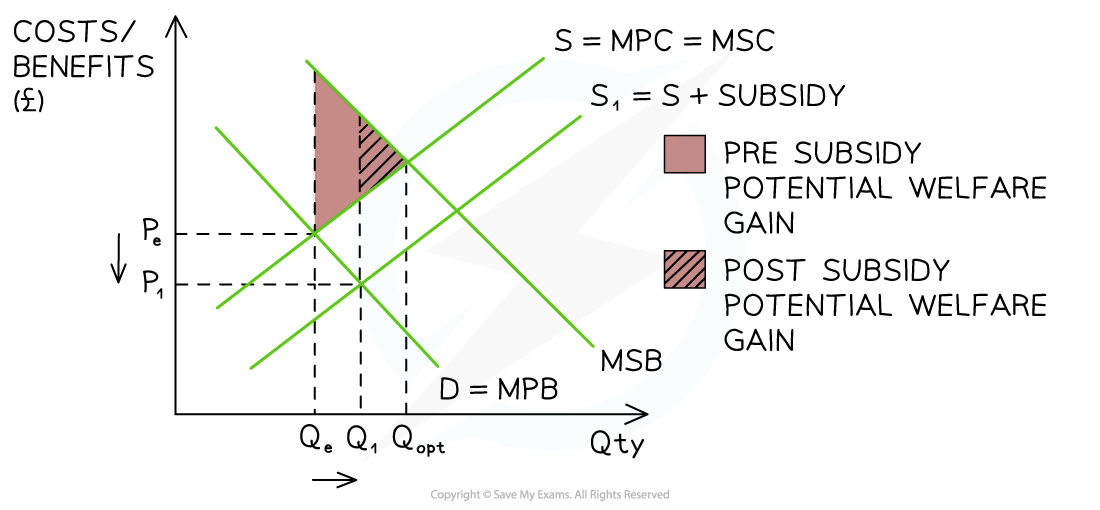

Subsidies

-

Governments frequently use subsidies to encourage production/consumption of merit goods such as energy efficient products, electric vehicles, healthcare, and education

Diagram analysis

-

The free-market equilibrium is at PeQe – where MPB = MSC

-

Market failure exists as MSB > MSC at equilibrium

-

Optimum level of output is at Qopt

-

There is under-consumption of this product

-

-

A subsidy shifts the supply curve right from S → S1

-

It does not completely eradicate the potential welfare gain but moves the market closer to the optimum level of output (Qopt)

-

The potential welfare gain has been reduced as shown in the diagram

-

-

The new market equilibrium is at P1Q1

-

This is a lower price and higher output

-

There is less under-consumption and so less market failure

-

Some of the external benefits available have been realised

-

Maximum Prices

-

Governments will often use maximum prices or price caps (opens in a new tab) in order to help consumers. Sometimes they are used for long periods of time, e.g. housing rental markets. Other times they are short-term solutions to unusual price increases, e.g. fuel

-

A maximum price is set by the government below the existing free market equilibrium price and sellers cannot legally sell the good/service at a higher price

Responses