Reasons to grow

-

Businesses grow to achieve a range of key objectives

1. Economies of scale

-

Internal economies of scale

-

As a business grows, it can reduce its average costs

-

For example, it may be able to buy supplies in bulk or invest in more efficient machinery

-

-

External economies of scale

-

These are benefits that come from being part of a growing industry, such as better infrastructure or access to a skilled workforce

-

2. Increased market power

-

A larger business may have more control over customers and suppliers

-

It can influence prices or force suppliers to offer better terms, such as longer trade credit periods

3. Increased market share and brand recognition

-

Growth allows a firm to reach more customers and become better known

-

This can lead to higher sales and increased customer loyalty

-

-

Increased brand recognition can help further growth, as customers are familiar with and trust the brand

4. Increased profitability

-

Profitability is a measure of how efficiently a company generates profit relative to its revenue or investment

-

As a firm grows, it may be able to generate more revenue while controlling costs, boosting profitability

-

Explaining economies of scale

-

As a business grows, it can increase its scale of output, generating efficiencies that lower its average costs of production

-

These efficiencies are called economies of scale

-

Economies of scale help large firms to lower their costs of production beyond what small firms can achieve

-

-

As a firm continues increasing its scale of output, it will reach a point where its average costs (AC) will start to increase

-

The reasons for the increase in the average costs are called diseconomies of scale

-

-

Internal economies of scale occur as a result of the growth in the scale of production within the firm

Economies of scale

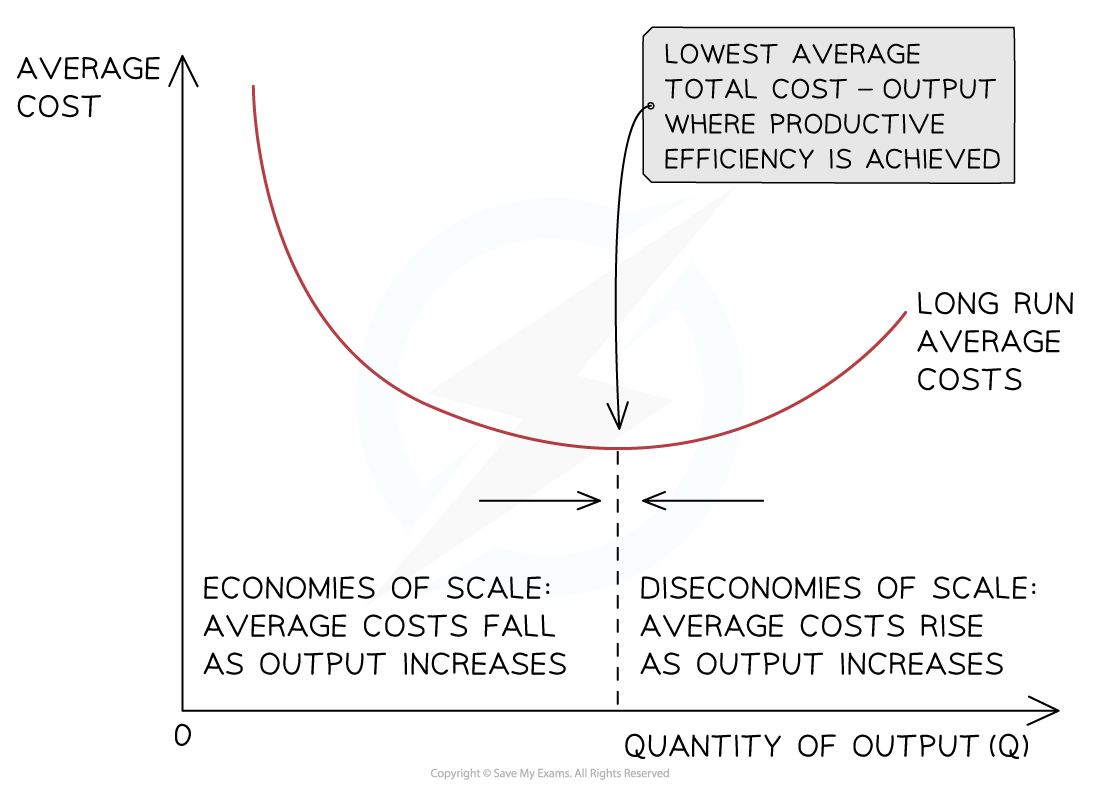

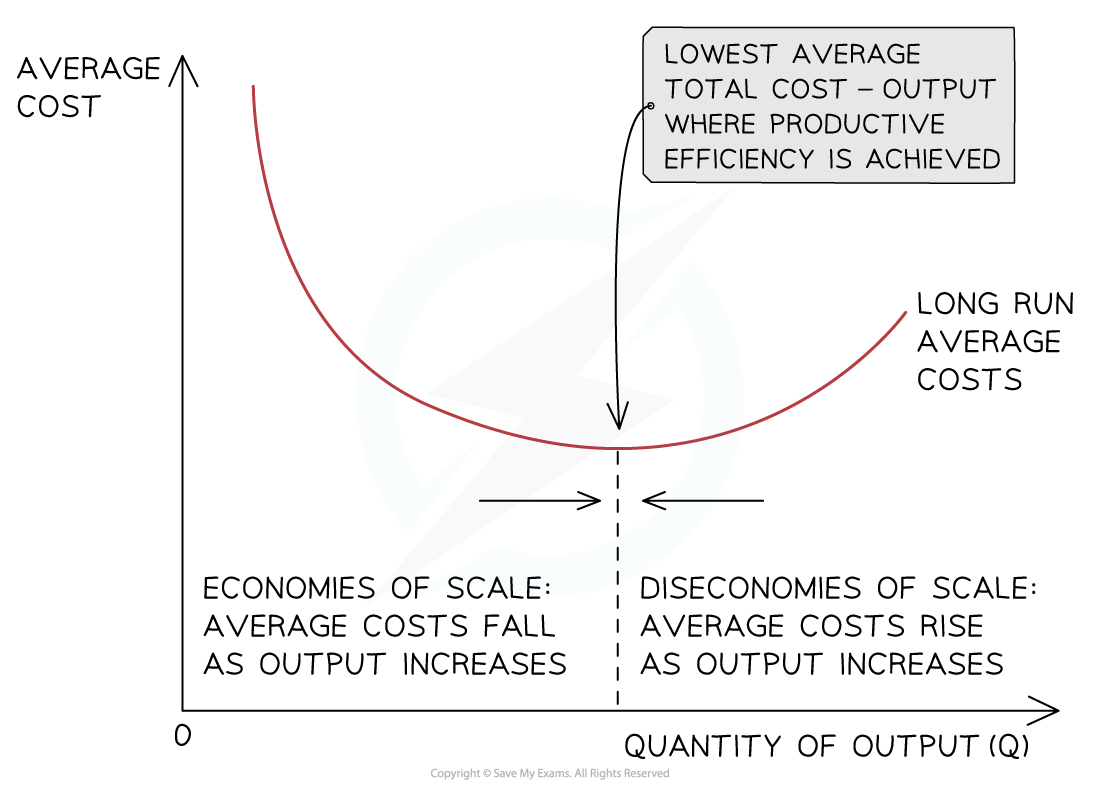

Diagram analysis

-

With relatively low levels of output, average costs are high

-

As the business increases its output, it begins to benefit from economies of scale, which lower the average cost per unit

-

At some level of output, a business will not be able to reduce costs any further — this point is called productive efficiency

-

Beyond this level of output, the average costs will begin to rise as a result of diseconomies of scale

Types of internal and external economies

Internal economies of scale

-

Internal economies of scale occur as a result of the growth in the scale of production within the business

-

The firm can benefit from lower average costs generated by factors that are inside the business

-

Types of internal economies of scale

|

Type |

Explanation |

|---|---|

|

Financial economies |

|

|

Managerial economies |

|

|

Marketing economies |

|

|

Purchasing economies |

|

|

Technical economies |

|

|

Risk-bearing economies |

|

External economies of scale

-

External economies of scale occur when there is an increase in the size of the industry in which the firm operates

-

The firm benefits from lower average costs generated by factors outside of the business

-

Sources of external economies of scale

|

Source |

Explanation |

|---|---|

|

Geographic cluster |

|

|

Transport links |

|

|

Skilled labour |

|

|

Favourable legislation |

|

Problems arising from growth

-

Rapid business growth may create challenges that can negatively impact a company’s operations and financial performance

-

Three of these challenges are diseconomies of scale, internal communication issues and overtrading

1. Diseconomies of scale

-

This occurs when a company grows too large, making it difficult to manage and control its operations

-

It may face challenges in coordinating its various departments, managing its workforce or maintaining quality control

-

The cost per unit ends up increasing as a result of these inefficiencies

2. Internal communication

-

Rapid growth may strain communication channels or result in miscommunication, causing conflicting priorities and a lack of coordination

-

This may result in delays, errors and missed opportunities, as well as impact employee morale

3. Overtrading

-

This occurs when a company takes on more business than it can handle, leading to a strain on its resources or an inability to meet its financial obligations (lack of liquidity)

-

This may cause cash flow problems or decreased customer satisfaction

-

E.g. a company that expands too quickly may struggle to hire and train enough staff to handle increased demand, leading to a backlog of orders and dissatisfied customers

-

Responses