Development of corporate strategy

-

A successful corporate strategy helps to provide a competitive advantage

-

Effective corporate strategy development requires careful consideration of a range of internal factors and the external environment in which the business operates

-

Internal factors include the human and capital resources available

-

External factors include the economic and political environments

-

-

Two strategic models used to develop a corporate strategy are the Ansoff matrix and Porter’s strategic matrix

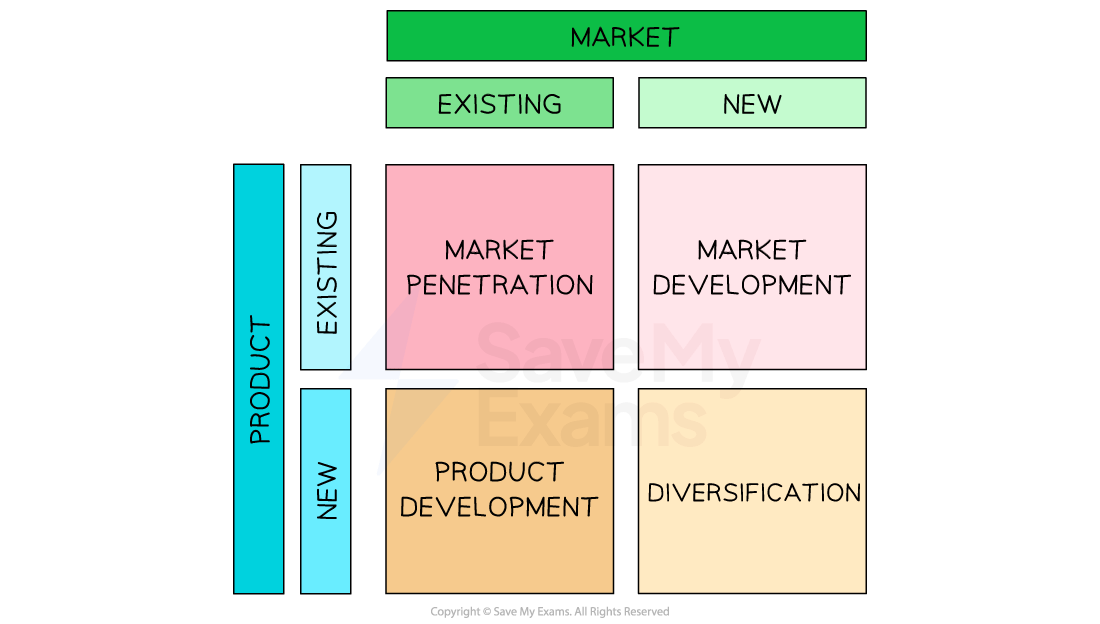

The Ansoff matrix

-

The Ansoff matrix is a tool for businesses with a growth objective

-

It is used to identify an appropriate corporate strategy and the level of risk associated with the chosen strategy

-

The model considers four elements, which are broken down into two categories:

-

The market — existing and new markets

-

The product — existing and new products

-

The Ansoff matrix: strategies for growth

-

The least risky strategy to achieve growth is to pursue a strategy of market penetration

-

This involves selling more products to existing customers by encouraging:

-

More regular use of the product

-

Increased use of the product

-

Brand loyalty of customers

-

-

-

Market development involves finding and exploiting new market opportunities for existing products by:

-

Entering new markets at home or abroad

-

Repositioning the product by selling to different customer profiles (selling to other businesses as well as directly to consumers)

-

Seeking complementary locations

-

For example, M&S Food has achieved significant growth since teaming up with fuel retailers such as BP and Applegreen and providing express retail outlets

-

-

-

Product development involves selling new or improved products to existing customers by:

-

Developing new versions or upgrades of existing successful products

-

Redesigning packaging and aesthetic features

-

Relaunching heritage products at commercially convenient intervals

-

For example, Cadbury relaunches Christmas-themed products each year, often with a subtle design change, to recapture the interest of customers

-

-

-

Diversification is the most risky growth strategy, as it involves targeting new customers with entirely new or redeveloped products

-

Examples of diversification include:

-

Tesco launching a range of financial products, including current accounts and credit cards

-

Greggs launching a range of themed clothing products

-

-

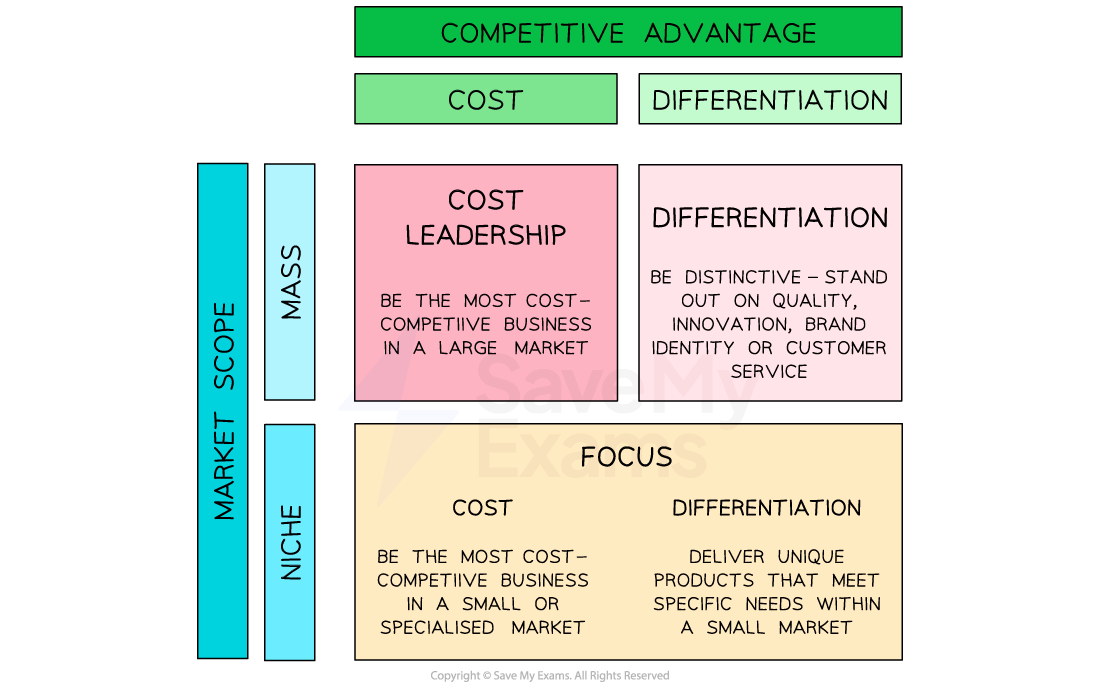

Porter’s generic strategic matrix

-

Porter’s generic strategic matrix identifies a range of strategies a business might adopt, considering:

-

Its source of competitive advantage (cost or differentiation)

-

The scope of the market in which it operates (mass or niche)

-

-

Porter argues that failing to adopt one of these strategies risks a business being “stuck in the middle” and unable to compete successfully with rivals in the market

Porter’s generic matrix

-

Businesses operating in the mass market should adopt either a cost leadership or a differentiation strategy, depending on what it is that makes them stand out from their competitors

-

Businesses that have a significant cost advantage over competitors should exploit this as much as possible to achieve success, which is called cost leadership

-

Businesses that are unable to operate as the most competitive on cost should adopt a strategy of differentiation

-

-

A business that operates in a niche market should adopt a focus strategy that closely meets the needs of its specific group of customers

-

A cost focus involves being the lowest cost competitor within the market niche

-

A differentiation focus involves offering specialised products within the niche market

-

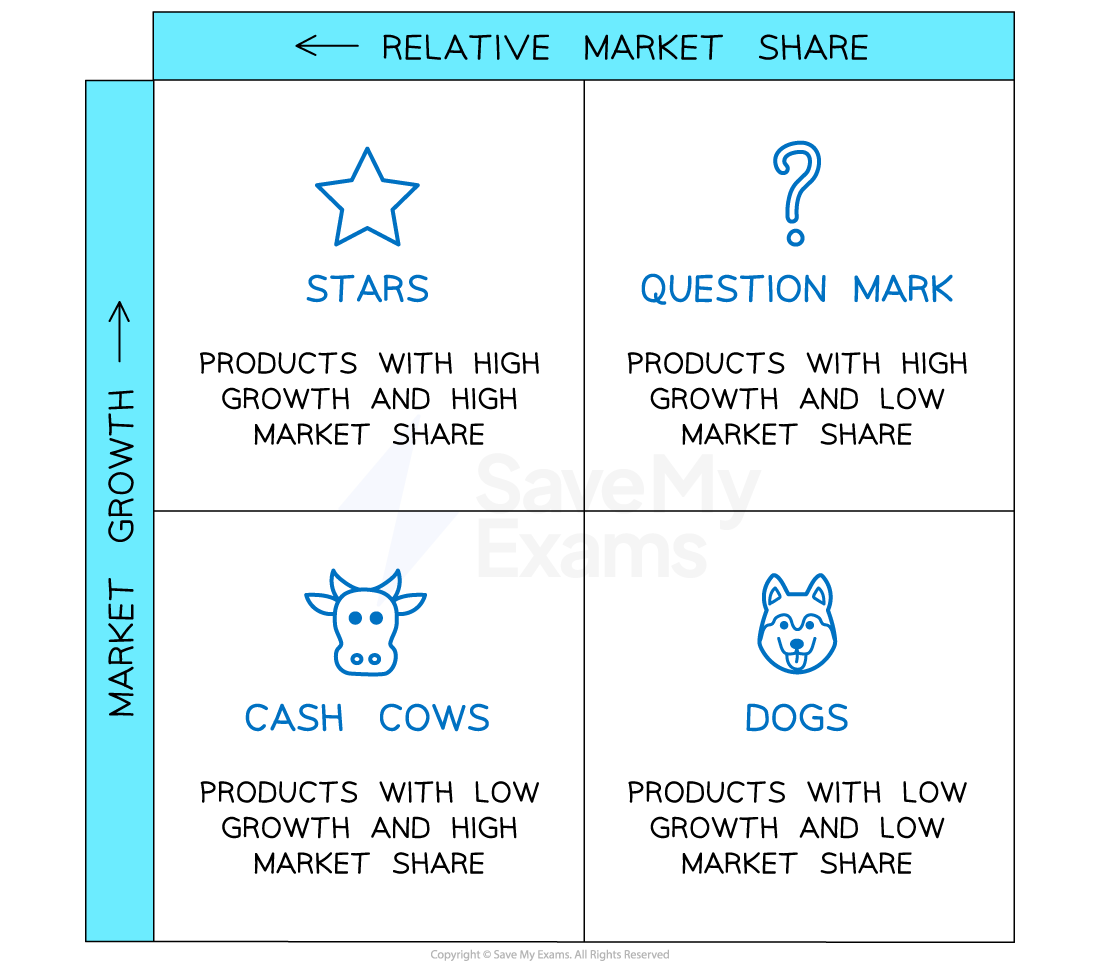

Portfolio analysis

-

Portfolio analysis involves a business carrying out a detailed evaluation of its full range of products so that appropriate strategies may be identified and pursued

Boston matrix

-

The Boston Matrix is a portfolio analysis tool that considers the relative market share of a firm’s products and the rate of growth within the market in which each product is sold

-

Stars are products sold in high-growth markets and have a high level of market share

-

Stars require some ongoing investment to maintain their market position and, if managed well, they are likely to become cash cows in the future

-

A market penetration strategy to increase sales revenue and maximise market share is likely to be appropriate

-

-

Cash cows are sold in lower-growth markets and have a high market share

-

Cash cows generate more cash than they need to maintain their market position and can be used to fund the development of other products in the portfolio

-

Businesses may seek new markets for these products if they are relatively risk-free

-

-

Question marks are sold in high-growth markets and have a relatively low market share

-

Question marks require significant investment if they are to improve their level of market share and become stars

-

There is a risk that question marks will become dogs when market growth rates slow

-

-

Dogs are sold in low-growth markets and have a relatively low market share

-

Dogs have little potential for future growth and should be divested so that finance and effort may be invested in other products

-

Achieving competitive advantage through distinctive capabilities

-

When a business has a particular strength that is very difficult for competitors to copy, it has a distinctive capability

-

The nature of that distinctive capability will determine the aims and objectives of the business and the strategies it will pursue to achieve them

Examples of distinctive capabilities

|

Distinctive capability |

Explanation |

|---|---|

|

|

|

|

|

|

Responses